E-invoicing in India: Requirements, Challenges and Solutions

Background

The Indian e-invoicing system was introduced in 2018 by the Goods and Service Tax Network (GSTN) Council to curb tax evasion, reduce errors and increase efficiency in the invoicing process. The first phase of the e-invoicing system went live in 2020 for taxpayers above the 500 crore rupee annual threshold. Over time, the GSTN council reduced the threshold limit for mandatory e-invoicing. This step has been taken as a part of the government's continuous efforts to bring more taxpayers under the e-invoicing regime. Further reductions in the threshold are expected.

The Scope

The scope of the e-invoicing system in India, at its current stage, covers all registered taxpayers whose aggregate turnover in any of the preceding financial years exceeds 5 crore rupees. As of August 1, 2023, these taxpayers are required to issue e-invoices in India.

It is important to note that e-invoicing is mandatory only for B2B, and B2G transactions if the government entity has a GSTIN. E-invoicing is currently not required for B2C transactions. However, the Indian GSTIN Council has expressed its intentions to include B2C transactions in the e-invoicing scope in the future.

In addition to B2B and B2G transactions, export transactions and reverse charge transactions are also in scope for e-invoicing in India. Self billing invoices are also in scope. However, zero rated supplies are exempt from the e-invoicing obligation.

E-invoicing Steps: What businesses need to do to comply?

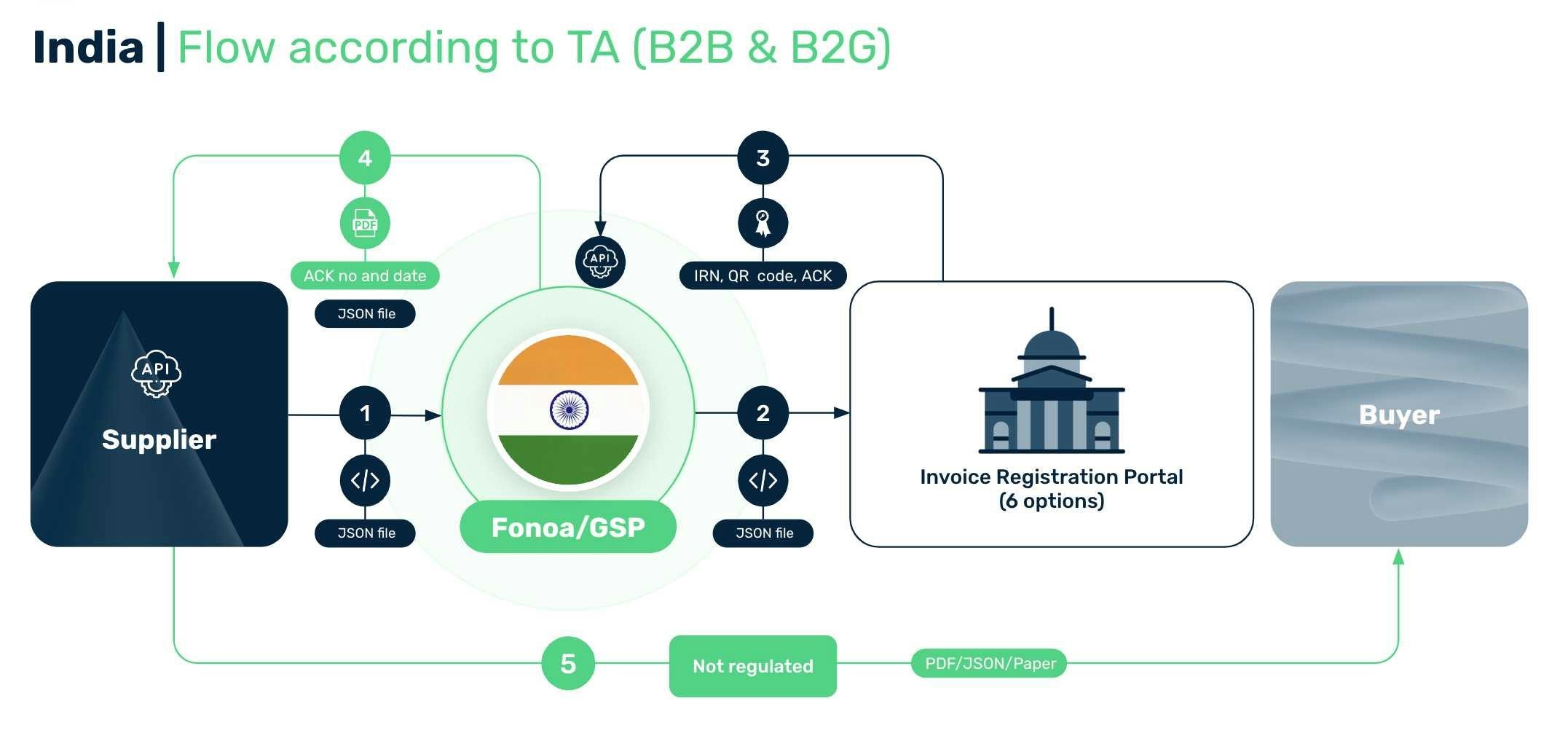

To comply with the e-invoicing system in India, businesses need to follow a series of steps. As the system involves an integration with an Invoice Registration Portal (IRP), compliance requires coordination between taxpayers, e-invoicing service providers, and the e-invoicing portals.

Taxpayers must submit their e-invoices to the Invoice Registration Portal (IRP). The National Informatics Centre (NIC) was the first IRP in India. Over time, 4 new private IRPs have been licensed by the government to act as IRPs. Also a second NIC (NIC2) has been added as an IRP.

Taxpayers may either connect to one of the IRPs directly or through a third party service provider, referred to as GST Suvidha Providers (GSPs).

Taxpayers must submit their e-invoices to one of the IRPs in a predefined JSON format. Once the IRP validates the e-invoices (including credit and debit notes), it assigns an Invoice Reference Number (IRN), signs the JSON, and creates QR code data (to be displayed on the PDF), an acknowledgement number and date.

After having the JSON signed and all other data returned, the taxpayer is permitted to generate a PDF or paper invoice including IRN, QR code, acknowledgement number. and date. The E-invoice exchange process is not regulated. It is possible for taxpayers to share invoices with their customers in PDF, JSON, paper or any other format.

E-invoices must be stored for a 6 year period in line with the the GST rules.

Challenges

Even though it is possible to cancel e-invoices, taxpayers can only cancel e-invoices within 24 hours through an API call. After 24 hours, the only way to cancel is to use the GSTIN platform which requires a manual log in and entry process.

Taxpayers who are required to issue e-invoices must also issue their e-waybills through the e-invoicing platform. If there is an e-waybill relating to an e-invoice, taxpayers cannot simply cancel an e-invoice. To be able to cancel an e-invoice with an existing e-waybill, the e-waybill must be cancelled first.

For e-commerce operators, it is mandatory to collect Tax Collected at Source (TCS). TCS is charged as a percentage on the net taxable supplies. However, there is no dedicated field in the e-invoice schema for TCS. This creates confusion. As a solution, one of the fields that relates to taxable supply can be used.

How Can Fonoa Help?

Fonoa e-invoicing provides a comprehensive and indispensable solution for businesses operating in India and other countries. Our tailored offering addresses the unique challenges of e-invoicing implementation in India. With Fonoa e-invoicing, you can trust that your business will meet regulatory requirements and operate efficiently and effectively in the Indian market. As your business scales, we are able to provide seamless coverage for new jurisdiction mandates with our single API. Our data validations within product allow you to be confident in the information you are reporting.

Contact us today to learn more about e-invoicing in India.