What Is E-Invoicing?

The term “e-invoicing” is used very broadly; it can mean anything from an invoice issued in an electronic format (e.g., a PDF), all the way to an entire method used to automate the issuance, transmission, and processing of electronic invoices.

One goal of e-invoicing is to automate invoice processing and establish an efficient business workflow, leading to quicker payments and thereby helping cash flow generation.

The error-prone nature of paper invoices and processing times are falling short of facilitating today's business needs, as manual processes are highly time-consuming and more costly. Automation requires eliminating traditional paper invoices and manual processes.

However, electronic invoicing has been is usually regulated over the last two decades by national tax authorities. Countries regulate the e-invoice format to enhance tax compliance and allow for (near) real-time tax information auditing.

The global rise of e-invoicing systems over the past years in many ways is directly tied back to the goal of combatting VAT/GST fraud and under-collection, in other words: closing the VAT gap. And it has proven to be a very effective measure for that.

Why are e-invoicing systems introduced across the world?

Many countries throughout the world have already introduced e-invoicing regulations and systems. And many more are working towards the introduction of e-invoicing systems. This is because having (near) real-time information on transactional data greatly improves the efficiency with which tax authorities can respond to errors in the system (errors or tax fraud).

Tax authorities have a much easier way to automate the audit of taxpayer data at scale if invoices have a standardized data structure and prescribed format and content. Meaning they increase their capacity to find anomalies in the system and automatically act on these towards taxpayers (tax adjustments, late interest and fines) as needed, thus, closing the VAT gap

Different types of electronic invoicing and reporting systems?

While the main policy aims are often similar for tax authorities when introducing these systems, there is no one standard approach to e-invoicing or real-time reporting systems. Each country creates and introduces its own approach to e-invoicing and the electronic exchange of invoice and/or transactional data.

Broadly speaking, however, there are a few common characteristics that tend to surface across systems:

- E-invoicing is typically referred to as the mandatory use of a predefined format to issue invoices electronically, with specific data on the invoice, and sometimes issued through or facilitated by a tax authority system. It is about the content and the end product.

- Real-time reporting or digital reporting systems require businesses to electronically send transactional data (Accounts Receivable or Accounts Payable) to tax authorities in near real-time. The core focus is receiving the transactional data, not the invoice as the end product.

Frequently, countries implement systems with characteristics of both e-invoicing and real-time reporting models. Some systems, for example, require pre-validation of invoice information by the tax authorities before the invoice can be officially sent to the buyer/recipient. This is called a pre-validation clearance model. Other countries allow validation to happen shortly after the buyer receives the invoice, a so-called post-validation clearance model. Each country’s model has its specifics and nuances and has different main policy goals.

Types of invoices and transactions affected

Countries may adopt mandatory e-invoicing or real-time reporting across all transactions or only parts of business traffic. For example, many countries only require large companies or B2B (business-to-business) transactions to follow specific rules, whereas others focus on B2B and B2C (business-to-consumer) transactions alike.

Most frequently, only domestic transactions are in the scope of these regulations. Sometimes, however, the rules extend to cross-border transactions. In countries like Italy, real-time reporting of transactions from sellers in Italy to non-Italy-based customers is in the scope of the local reporting rules. Another example is Taiwan, which also includes the obligation for foreign sellers to report their sales to Taiwan-based consumers (B2C) in near real-time.

Some countries, such as those in the EU, LATAM, and APAC, have regulated B2B and B2C e-invoice formats because e-invoicing has become a way for tax authorities to perform efficient VAT controls beyond automation. However, this has led to the term “e-invoicing” being used outside of its core meaning. Some tax authorities have introduced e-invoicing systems that do not require trading partners to exchange e-invoices in electronic format, yet they still call it e-invoicing. Therefore the term has evolved to have a broader meaning than its initial occurrence.

As e-invoicing is now used more broadly, the term sometimes creates confusion around the obligations of e-invoicing systems. Therefore, each e-invoicing system requirement must be examined in detail to recognise different elements and understand the full meaning. This is especially significant when taxpayers acquire e-invoicing solutions from third-party service providers.

What is the impact of E-invoicing on businesses?

Due to all the different e-invoicing and real-time reporting requirements, global businesses must continuously focus on understanding which rules apply to them. Once clear on what is needed to be compliant, businesses will often need to adjust their systems to ensure they capture or generate the relevant data and fields needed for each transaction. They will then need to find third-party solutions that can help them generate and issue compliant e-invoices or report transactional data in near real-time to the tax authorities. Sometimes, certified third-party solutions are required for outsourcing such operations.

This entire process often requires systems integrations, which can be resource intensive. For that reason, businesses want to minimize the number of third-parties involved and the solutions needed to support their organization globally. Ideally, companies want to have only one third-party solution to integrate with. Identifying a third-party solution provider’s global country coverage and willingness to cover yours is crucial before reaching an agreement.

Potential business advantages of E-invoicing

While complying with e-invoicing rules and real-time reporting worldwide is complex and increases the overall compliance burden for companies, there is a silver lining here. There are upsides and opportunities involved.

For example, to achieve full accounts payable (AP) automation, accounts payable systems must be able to read and process invoice data and initiate payments. For the issuing system (accounts receivable) and receiving system (accounts payable) to easily recognise and consume the data, e-invoice data must be standardized. This is why alignment between trading partners is crucial regarding the format of e-invoices.

Luckily, some standards can be used to achieve this. By using standards, businesses can achieve higher degrees of AP/AR automation while reducing overall cost, resource needs, and processing time. Some common business standards are EDI and PEPPOL.

What is Electronic Data Interchange (EDI)?

One of the most common technology methods used for e-invoicing is EDI. EDI is used for automating business-to-business document exchange. The use case is not limited to e-invoices and credit/debit notes. Purchase orders, contracts and other business documents may also be exchanged in an automated way through the EDI. Any document created in the accounting system/ ERP system may automatically appear in the trading partner’s software through the use of EDI. EDI provides supply chain visibility through EDI messages and notifications and cost reduction through automation. EDI may use different file formats such as EDIFACT, XML formats and others. When e-invoicing is used in the context of business-to-business automation, most e-invoicing solutions work through the EDI.

When used for business-to-business automation, a considerable amount of e-invoicing solutions work through the EDI. However, EDI requires each supplier and buyer to integrate their software systems, which creates limitations as every new integration requires a new development effort.

What is Pan-European Public Procurement Online (Peppol)?

Peppol is an exchange network that enables parties in the network to communicate and exchange documents electronically. It is mainly used for public procurement processes. Especially for B2G e-invoicing in Europe, Peppol is used as a network by many government authorities. Businesses in the Peppol network may also use it for B2B automation purposes. Peppol allows buyers and suppliers to trade and exchange documents freely in the network. This eliminates the limitations of EDI, as communicating with different entities does not require a separate integration.

Future of e-invoicing

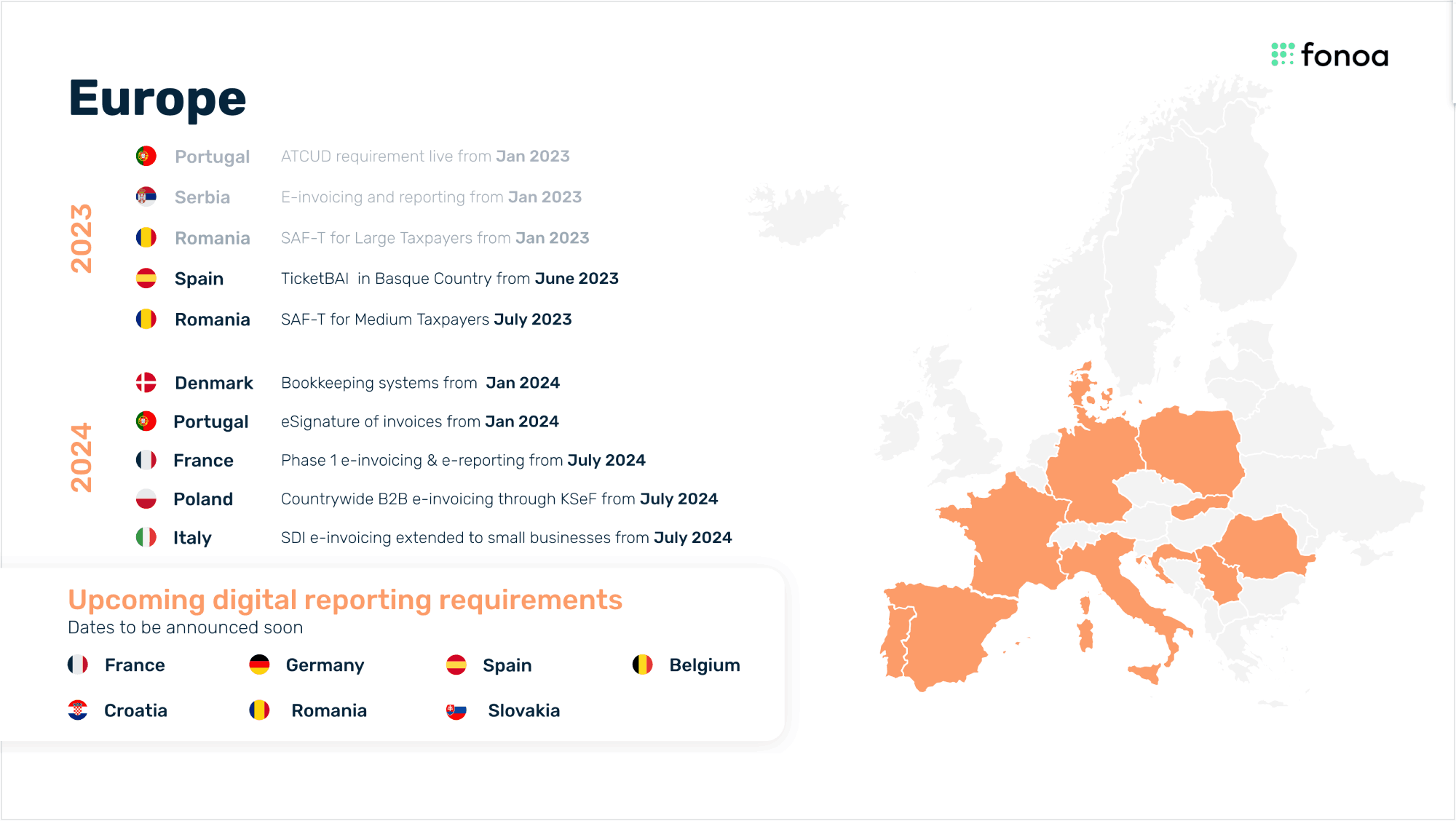

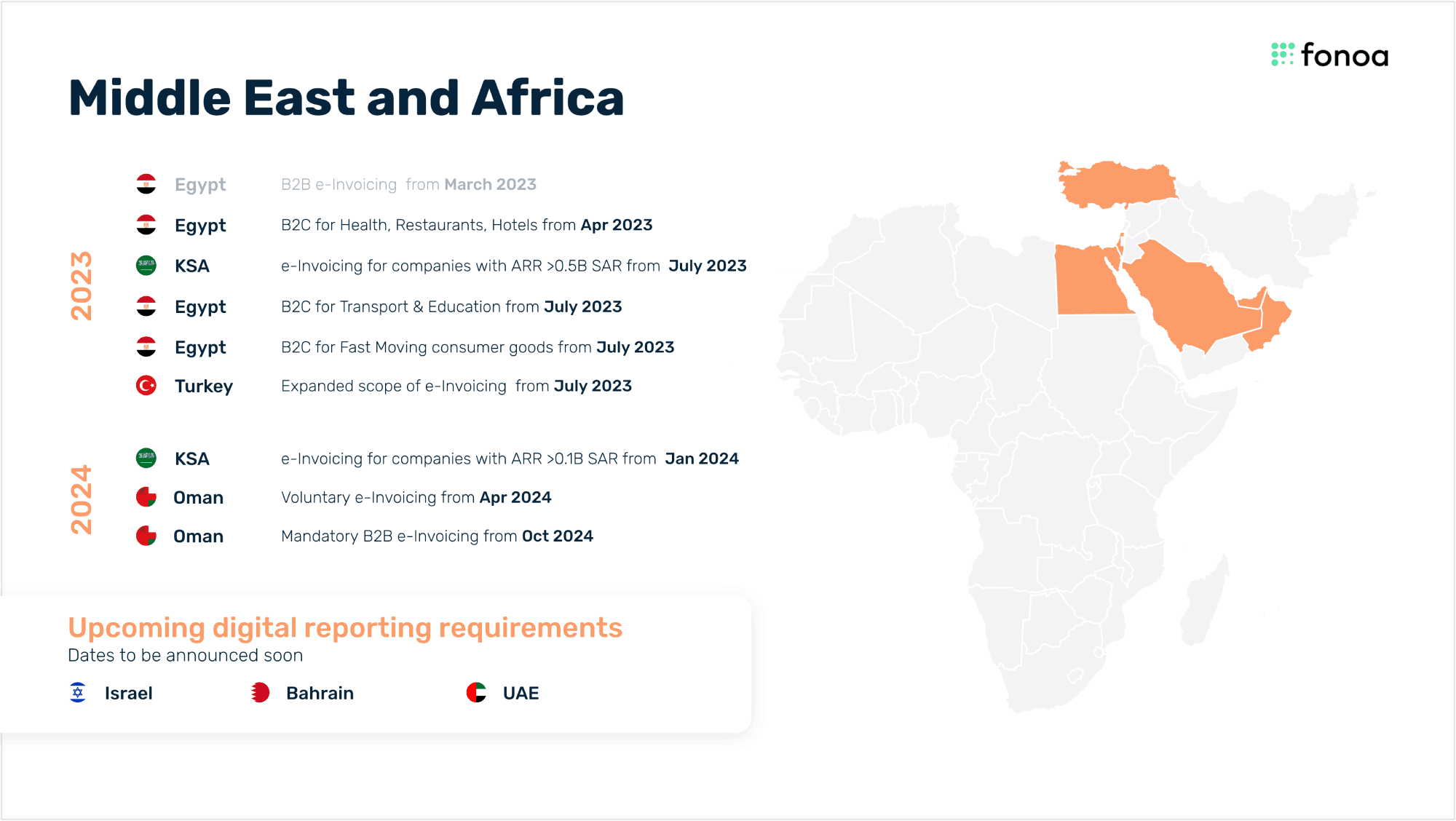

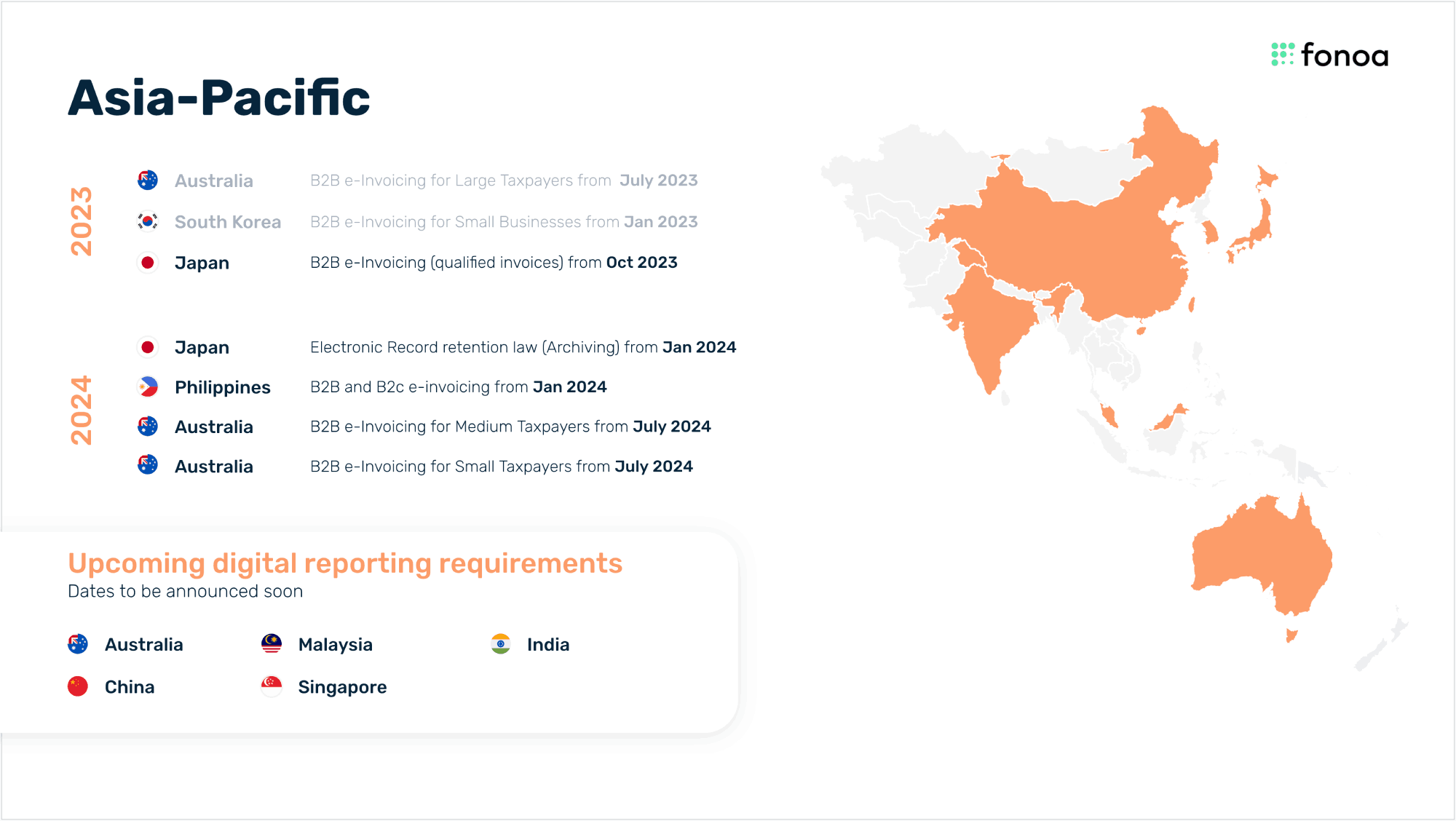

E-invoicing has been around for more than a couple of decades, prompted by the use of technology in business processes. However, what gave e-invoicing its rise was the introduction of e-invoicing mandates by tax authorities all around the globe. This brings efficiency to businesses and provides visibility to tax authorities, thereby reducing the VAT gap. It's not a question of if but when to introduce new e-invoicing mandates across different countries and continents. Here is a snapshot of countries that recently implemented new e-invoicing or real-time reporting requirements or are working on implementing them soon.

Fonoa has a solution for your E-invoicing compliance

With Fonoa, you comply with e-invoicing regulations in countries where the tax authority requires the generation and transmission of e-invoices or reporting of data in a structured electronic format. Fonoa is one centralized and standardized tax technology solution across countries, made for high-volume global businesses.

Fonoa’s solution has the most advanced technology in automated data cleansing, validation and verification of tax data, minimizing the need for human intervention and reducing risk.

Contact Fonoa today.