VAT Guide for Businesses with Customers in Chile

VAT Rates in Chile

The standard Value Added Tax (”Impuesto al Valor Agregado” (IVA)) rate in Chile is 19%, with some exemptions from Chilean VAT, such as cultural and sporting events.

Chile does not have reduced VAT rates.

There are additional taxes ranging from 15% to 50% on certain goods such as jewelry.

VAT Registration Thresholds in Chile

- VAT registration threshold for domestic established sellers: No registration threshold

- VAT registration threshold for non-established sellers: No registration threshold

- VAT registration threshold for non-resident suppliers of Digital Services: No registration threshold

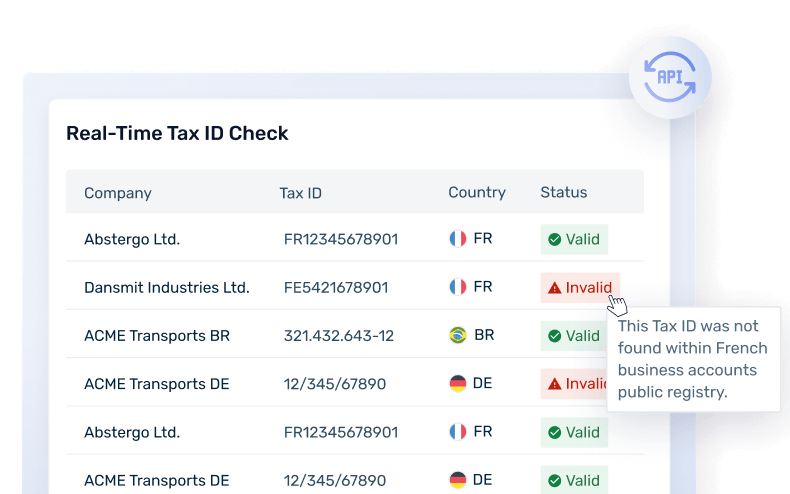

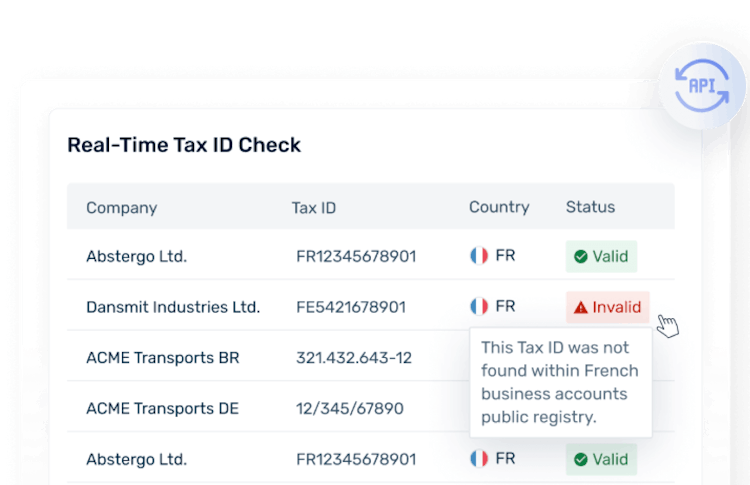

Chilean VAT Number Format

- Both individuals and businesses have a 9-character identifier, consisting of an 8-digit serial number and a 1-digit verification character (number 0-9 or the letter K).

- Individuals: Rol Único Nacional (RUN)

- Businesses: Rol Único Tributario (RUT)

- For individualsFormat: 12.345.678-1

- For businessesFormat: 87.654.321-K

VAT on Digital Services in Chile

Digital services provided by non-resident taxpayers to end consumers in Chile have been subject to VAT since 2020. Non-resident service providers should register and account for VAT on these transactions.

In the case of B2B digital services, the Chilean resident should account for the VAT under the reverse charge mechanism.

VAT Rate: 19% VAT applied to the sale of affected digital services

Taxable digital services in Chile

- Digital entertainment content, such as videos, music, games or other analogous content, by means of downloading, streaming or other technology, including for these purposes texts, magazines, newspapers and books

- Software, storage, computing platforms or infrastructure (e.g. SaaS)

- Advertising

Will your business need to pay VAT on digital services in Chile in 2024?

Learn More About VAT on Digital Services in Chile

Marketplace & Platform Operator Rules in Chile

Marketplaces & platforms facilitating the supply of digital services are regarded as intermediaries between the supplier and the end consumer. As such, they should register and fulfill VAT obligations instead of the supplier.

Invoice Requirements in Chile

Invoices should contain the following:

- Document & general transaction information

- Invoice type

- Sequential number of the invoice

- Branch name of the Tax Authority where the taxpayer is based

- Date of issue

- Supplier information

- Name, address, and VAT Number

- Line of business

- Customer information

- Name, address, and VAT Number

- Line of business

- Financial transaction information

- Description of the goods or services

- Quantity

- Unit price excl. VAT

- VAT rate(s)

- VAT amount

- Total value of the goods or services excl. VAT per rate

- Total value of the goods or services incl. VAT

- Terms of payment

- Amounts in CLP

E-Invoicing & Digital Reporting for Chile

Mandatory B2B e-invoicing was introduced in phases, starting with large taxpayers in 2014, and it became mandatory for all taxpayers in 2018. E-invoicing was extended to B2C transactions in 2021.

Learn more about E-Invoicing in Chile

Governmental Body Responsible for E-invoicing and Digital Reporting in Chile

The Servicio de Impuestos Internos (SII) is the body responsible for e-invoicing.

All e-invoicing information can be found on the SII’s website including legislation, technical guides, and FAQs.

VAT Payments and Returns in Chile

Full VAT Returns

Chile has simplified VAT returns for foreign companies supplying qualifying digital services, as they are subject to a simplified tax regime. For more information, see Chile VAT on Digital Services Guide.

Penalties in case of late filings or misdeclarations

In the case of late filing of VAT returns and payments, the Chilean Tax Authority enforces the following penalties:

- Up to 60% of the taxes due, depending on the severity

- 1.5% interest per month

Fonoa does not provide professional tax opinions or tax management advice specific to the facts and circumstances of your business and that your use of the Specification, Site, and In addition, due to rapidly changing tax rates and regulations that require interpretation by your qualified tax professionals, you bear full responsibility to determine the applicability of the output generated by the Specification and Services and to confirm its accuracy. No professional tax opinion and advice. Fonoa does not provide professional tax opinions or tax management advice specific to the facts and circumstances of your business and that your use of the Specification, Site, and In addition, due to rapidly changing tax rates and regulations that require interpretation by your qualified tax professionals, you bear full responsibility to determine the applicability of the output generated by the Specification and Services and to confirm its accuracy.