VAT Guide for Businesses with Customers in Germany

VAT Rates in Germany

In Germany, the Value Added Tax is called Mehrwertsteuer (MwSt), but domestic citizens often refer to it by the name, Umsatzsteuer (USt).

The standard VAT rate in Germany is 19%, with some services exempt from German VAT, such as insurance, financial services, etc.

Due to Covid-19, the VAT rate for restaurant and catering services has been reduced to 7% for a limited period until December 31, 2023. The sale of drinks is excluded from this temporary reduction measure.

The following German territories are excluded from the scope of VAT:

- The Island of Heligoland, and

- The territory of Büsingen

VAT Registration Thresholds in Germany

- VAT registration threshold for established domestic sellers: There is no registration threshold. Domestic taxpayers can benefit from the small business owners’ VAT exemption threshold. To be in a position to apply this simplified VAT regime, they should fulfill the following conditions:

- Turnover for the past year is not higher than EUR 22 000,

- and expected turnover for the current operating year will not be higher than EUR 50 000.

- VAT registration threshold for non-established sellers: No registration threshold.

- VAT registration threshold for intra-EU distance selling of goods and B2C telecommunications, broadcasting & electronic services (TBE): EUR 10,000 (net) per calendar year.

- VAT registration threshold for non-resident, non-EU based suppliers of Electronically Supplied Services (ESS): No registration threshold.

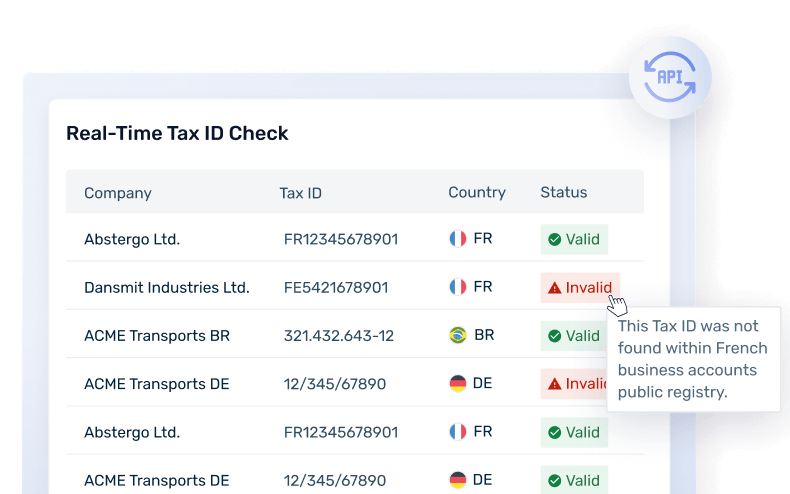

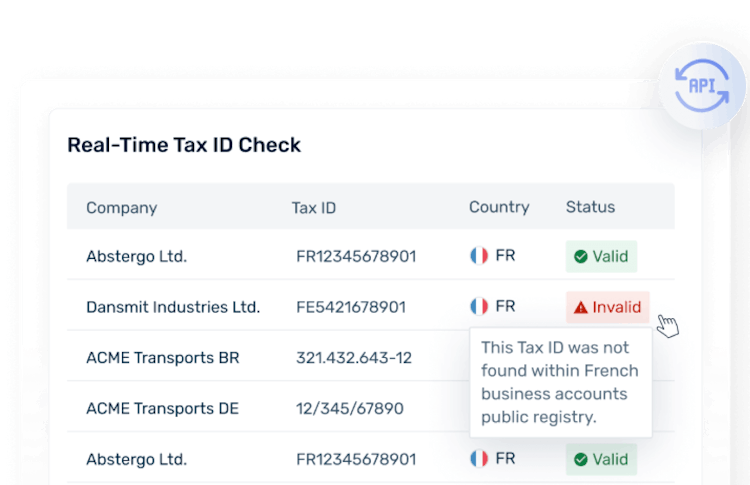

German VAT Number Format

The Tax Identification number for natural persons is an eleven-digit identification number issued to every person who resides in Germany and is registered there. The Authority responsible for issuing Tax IDs is the Federal Central Tax Office.

- For individuals, Tax Identification Number(Steuer-ID)

- Format: 23456789012

The tax number is issued by the responsible tax office directly to the taxpayer, being that legal or natural person. It’s unique per taxpayer. The tax number is composed of 10-11 characters, however, sometimes it is written in the unified federal format, where the first two digits represent the state of the business. It's structured differently per federal state. This tax number is used to record all tax transactions; in general, it should be stated in all tax correspondence. The structure of the tax number is divided into different codes. The first part represents codes of the federal tax office; this is followed by the district number of the federal state, and as the last part - there is a section that represents the identification number of the business.

- For businesses - Tax number (Steuernummer)

- Format: 1122081500001

Value Added Tax identification number represents a unique Tax ID, which taxpayers will use for intra-Community supplies. It’s assigned by the Federal Central Tax Office. This number is used as an addition to the general Tax ID, which is mainly used for cross-border transactions. The VAT ID is structured from the two capital letters at the beginning representing the country - DE and nine digits.

- For businesses - VAT number (Umsatzsteuer-Identifikationsnummer)

- Format: DE 123456789

- For individualsFormat: 23456789012

- For businessesFormat: 1122081500001

- OtherFormat: DE 123456789

VAT on Electronically Supplied Services (ESS) in Germany

Digital Services in the European Union (EU) are often referred to as electronically supplied services (ESS). Germany applies the harmonized EU VAT rules for ESS.

- For B2B supplies of such services, the general place of supply rule for services has to be considered.

- For B2C supplies, the EU ESS rules should apply to foreign companies selling to German consumers.

Under the EU’s B2C ESS rules, until the sales value reaches EUR 10,000 (including distance sales of goods), the seller can charge VAT where it is resident. Once the sales exceed the threshold, the seller should register for VAT in Germany, or it can choose to account for the VAT under the EU’s One Stop Shop (OSS) regime.

VAT Rate: 19% VAT rate is typically applied on the sales of Electronically Supplied Services.

Will your business need to pay VAT on digital services in Germany in 2024?

Learn More About VAT on Digital Services in Germany

Marketplace & Platform Operator Rules in Germany

Germany applies the harmonized European Union’s (EU) VAT rules for marketplace & platform operators.

Supply of goods

A marketplace is deemed to have received and supplied the goods themselves. This transaction is split into two supplies:

- A supply from the underlying supplier to the marketplace (deemed B2B supply)

- A supply from the marketplace to the final customer (deemed B2C supply).

This rule covers the following:

- Distance sales of goods imported to the EU with a value not exceeding EUR 150

- Supplies of goods to customers in the EU, irrespective of their value, when the underlying supplier is not established in the EU (both domestic supplies and distance sales within the EU are covered).

Supply of services

When electronically supplied services are sold through an intermediary, e.g. a marketplace for applications, the intermediary is deemed to have received and supplied the services themselves. Therefore, the VAT liability shifts to the intermediary from the underlying supplier.

Invoice Requirements in Germany

Invoices should include the following elements in Germany:

- Document & general transaction information

- The date of invoice issuance

- The sequential number within one or more series of numbers assigned once by the supplier to uniquely identify the invoice

- The date of delivery of goods or performance of the service; should be indicated in the case of advance payment as the date of receipt of the consideration or part of the consideration, provided that the date of receipt is fixed and does not coincide with the date of issue of the invoice

- Supplier information

- Full name, address, and tax number (Steuer-ID) or the VAT identification number

- Customer information

- Full name and address

- Financial transaction information

- The quantity and type (customary designation) of the goods or the scope and type of service

- The consideration for the supply, broken down by tax rates and individual exemptions, as well as any reduction in the consideration agreed in advance unless it has already been taken into account in the consideration

- The applicable tax rate and the amount of tax due on the consideration or, in the case of a tax exemption, an indication that the supply or other service is subject to a tax exemption.

- Additional information that may be required:

- Group VAT number

- Discount

- VAT exemption reference

- The term “reverse charge” or “self-billing”

- Name, address, and VAT number of the fiscal representative

E-Invoicing & Digital Reporting for Germany

The implementation of the E-Invoicing system in Germany for B2G transactions started in 2017. The plan is to finalize the project within 2025 so that the only form of the invoice valid within B2G operations shall be an e-invoice.

From November 27, 2020, the suppliers of Federal Government institutions are obliged to send only e-invoices to public authority buyers. Only the E-Invoices in the meaning of the Federal E-Invoice Ordinance may be sent to the authorities.

The e-invoices should be sent to the State platforms, specifically developed and established for this purpose. These platforms represent the central access points for reporting of e-invoices. There are, at the moment two main central platforms for reporting of e-invoices:

- The Central Federal Invoice Receipt Platform(ZRE), the platform of central Federal Administration(e.g. ministries and higher federal authorities) and

- Online Access Law - Compliant Invoice Receipt Platform(OZG - RE) where economic operators should submit e-invoices intended to affiliate institutions of the indirect federal administration and cooperating federal states.

According to the Federal E-Invoicing Ordinance, for B2G transactions the preferred standard which should be used is XRechnung. This doesn’t exclude the possibility of using other formats.

Learn more about E-Invoicing and Digital Reporting in Germany

Governmental Body Responsible for E-invoicing and Digital Reporting in Germany

Federal Ministry of the Interior and Community (BMI) alongside the Federal Ministry of Finance (BMF) are the two main central public authorities responsible for the development, monitoring, and implementation of e-invoicing on the Federal level.

Specifically designed public authority for coordinating and implementing parts of the e-invoicing project is The Coordination Office for IT Standards (KoSIT) which maintains and develops the German E-Invoicing Standard (XRechnung) on behalf of the IT Planning Council . KoSIT became the German Peppol authority in June 2018, with the responsibility of maintaining XRechnung.

VAT Payments and Returns in Germany

Full VAT Returns

Penalties in case of late filings or misdeclarations

In the case of the late filing of VAT returns and payments, the German Tax Authority enforces the following penalties and the exact amount is at the discretion of the responsible tax officer. However, there are also limits here:

- If the VAT is paid late, penalty interest is charged at a rate of 1% per month of the tax liability,

- If a VAT return is filed late, a fine of up to 10% of the assessed tax amount may be imposed, up to a maximum of EUR 25,000.

Interest should also be imposed at 0.5% per month.

Fonoa does not provide professional tax opinions or tax management advice specific to the facts and circumstances of your business and that your use of the Specification, Site, and In addition, due to rapidly changing tax rates and regulations that require interpretation by your qualified tax professionals, you bear full responsibility to determine the applicability of the output generated by the Specification and Services and to confirm its accuracy. No professional tax opinion and advice. Fonoa does not provide professional tax opinions or tax management advice specific to the facts and circumstances of your business and that your use of the Specification, Site, and In addition, due to rapidly changing tax rates and regulations that require interpretation by your qualified tax professionals, you bear full responsibility to determine the applicability of the output generated by the Specification and Services and to confirm its accuracy.