VAT Guide for Businesses with Customers in Greece

VAT Rates in Greece

The standard VAT rate (”Foros prostithemenis aksias” (FPA)) in Greece is 24%, with some services exempt from Greek VAT. Exempt supplies include, amongst others, postal services, finance, insurance, and health care.

The VAT rates are reduced by 30% in the prefectures of Lesbos, Chios, Samos, the Dodecanese, the Cyclades and the Aegean islands of Thassos, Samothraki, the northern Sporades and Skiros.

- The standard rate for these regions is 16%, the reduced rate is 9% and the super reduced rate is 5%.

The following Greek territories are excluded from the scope of VAT:

- Mount Athos

VAT Registration Thresholds in Greece

- VAT registration threshold for domestic established sellers: No registration threshold

- VAT registration threshold for non-established sellers: No registration threshold

- VAT registration threshold for intra-EU distance selling of goods and B2C telecommunications, broadcasting & electronic services (TBE): EUR 10,000 (net) per calendar year

- VAT registration threshold for non-resident sellers of Electronically Supplied Services: No registration threshold

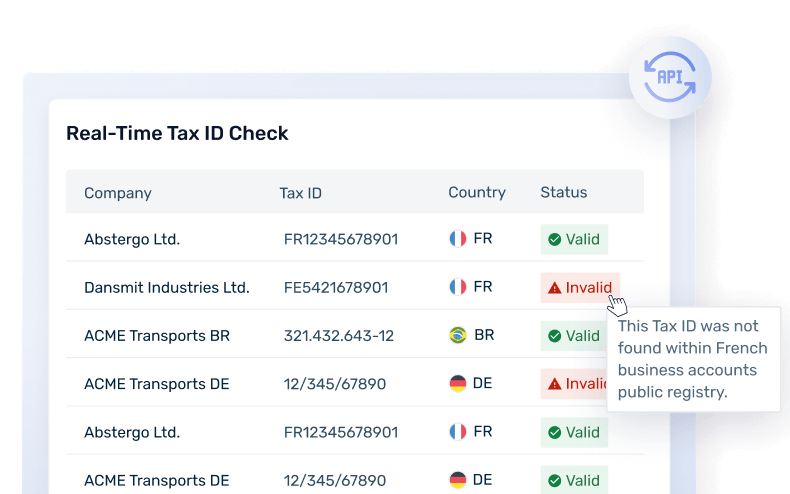

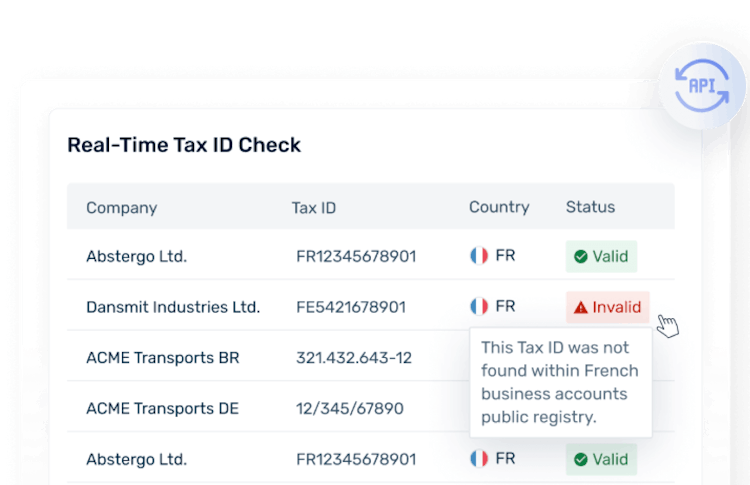

Greek VAT Number Format

- Individuals: Tax Identification Number (TIN)

- Businesses: VAT number

- For individualsFormat: 999999999

- For businessesFormat: EL123456789

VAT on Electronically Supplied Services (ESS) in Greece

Digital Services in the European Union (EU) are often referred to as electronically supplied services (ESS). Greece applies the harmonized EU VAT rules for ESS.

- For B2B supplies of such services, the general place of supply rule for services has to be taken into consideration.

- For B2C supplies, the EU ESS rules should apply to foreign companies selling to Greek consumers.

Under the EU’s B2C ESS rules, until the sales value reaches EUR 10,000 (including distance sales of goods), the seller can charge VAT where it is resident. Once the sales exceed the threshold, the seller should register for VAT in Greece, or it can choose to account for the VAT under the EU’s One Stop Shop (OSS) regime.

VAT Rate: 24% VAT is typically applied to the sale of affected Electronically Supplied Services.

Will your business need to pay VAT on digital services in Greece in 2024?

Learn More About VAT on Digital Services in Greece

Marketplace & Platform Operator Rules in Greece

Greece applies the harmonized European Union’s (EU) VAT rules for marketplace & platform operators.

Supply of goods

A marketplace is deemed to have received and supplied the goods themselves. This transaction is split into two supplies:

- A supply from the underlying supplier to the marketplace (deemed B2B supply)

- A supply from the marketplace to the final customer (deemed B2C supply).

This rule covers the following:

- Distance sales of goods imported to the EU with a value not exceeding EUR 150

- Supplies of goods to customers in the EU, irrespective of their value, when the underlying supplier is not established in the EU (both domestic supplies and distance sales within the EU are covered).

Supply of services

When electronically supplied services are sold through an intermediary, e.g. a marketplace for applications, the intermediary is deemed to have received and supplied the services themselves. Therefore, the VAT liability shifts to the intermediary from the underlying supplier.

Invoice Requirements in Greece

Invoices should contain the following information in Greece:

- Document & general transaction information

- Invoice date

- Invoice sequencing number

- Supplier information

- Name, address, and VAT number

- Customer information

- Name, address, and VAT number

- Financial transaction information

- Description of the goods or services

- Rate of VAT applied to each item

- The total amount including VAT

E-Invoicing & Digital Reporting for Greece

Electronic invoicing is allowed in Greece, but not mandatory. Greek-established businesses may issue invoices either in paper or electronic form.

Greek taxpayers have two options for issuing and exchanging e-invoices:

- Use services of a locally accredited myDATA Agent who may or may not be supporting the taxpayer with myDATA reporting obligations; or

- Use services of any e-invoicing service provider preferred by the taxpayer, irrespective of whether the Greek taxpayer uses services of ERP/accounting software or myDATA Agent to fulfil the myDATA reporting obligations.

Even though there is no e-invoicing mandate in Greece, there is an e-bookkeeping (e-accounting) obligation called MyData. Taxpayers must submit their accounting data to the MyData platform in real time or periodically. MyData platform populates accounting books of taxpayers through the data reported. Ledger entries and sales & purchase invoices are recorded in Mydata books.

Learn more about E-Invoicing and Digital Reporting in Greece

Governmental Body Responsible for E-invoicing and Digital Reporting in Greece

The Greek Ministry of Finance (”Υπουργείο Οικονομικών”) and AADE (Independent Authority for Public Revenue) are responsible for e-invoicing in Greece.

VAT Payments and Returns in Greece

Full VAT Returns

Greece does not provide simplified VAT returns for VAT-registered non-resident taxpayers supplying qualifying electronically supplied services. Instead, they can avoid VAT registration in Greece and use the EU One-Stop Shop (OSS) return.

Penalties in case of late filings or misdeclarations

In the case of the late filing of VAT returns and payments, the Greek Tax Authority should enforce the following penalties:

- Late payment:

- Interest calculated on the underpayment or nonpayment of VAT at the current monthly interest rate

- Late submission:

- Penalties in the range of EUR 100-500

- Inaccurate filing or failing to file VAT return:

- Penalty equal to 50% of the unpaid VAT, or 50% of the additional input tax amount refunded

Fonoa does not provide professional tax opinions or tax management advice specific to the facts and circumstances of your business and that your use of the Specification, Site, and In addition, due to rapidly changing tax rates and regulations that require interpretation by your qualified tax professionals, you bear full responsibility to determine the applicability of the output generated by the Specification and Services and to confirm its accuracy. No professional tax opinion and advice. Fonoa does not provide professional tax opinions or tax management advice specific to the facts and circumstances of your business and that your use of the Specification, Site, and In addition, due to rapidly changing tax rates and regulations that require interpretation by your qualified tax professionals, you bear full responsibility to determine the applicability of the output generated by the Specification and Services and to confirm its accuracy.