VAT Guide for Businesses with Customers in the Netherlands

VAT Rates in the Netherlands

The standard Value Added Tax (”Belasting over de toegevoegde waarde” (BTW)) rate in The Netherlands is 21%, with some services exempt from Dutch VAT, such as financial services or the supply of immovable property.

The following Dutch territories are excluded from the scope of Dutch VAT:

- The islands of Bonaire, Sint Eustatius, and Saba (”BES Islands” or “Caribbean Netherlands”)

VAT Registration Thresholds in the Netherlands

- VAT registration threshold for domestic established sellers: No registration threshold

- VAT registration threshold for non-established sellers: No registration threshold

- VAT registration threshold for intra-EU distance selling of goods and B2C telecommunications, broadcasting & electronic services (TBE): EUR 10,000 (net) per calendar year

- VAT registration threshold for non-resident, non-EU based suppliers of Electronically Supplied Services (ESS): No registration threshold

The Netherlands has a small business scheme under which Netherlands-based businesses whose turnover does not exceed EUR 25,000 in a year are exempted from issuing invoices and filing VAT returns.

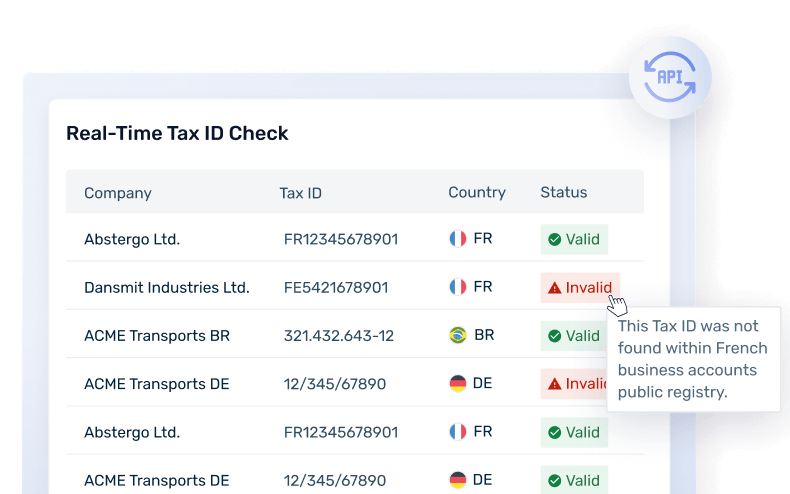

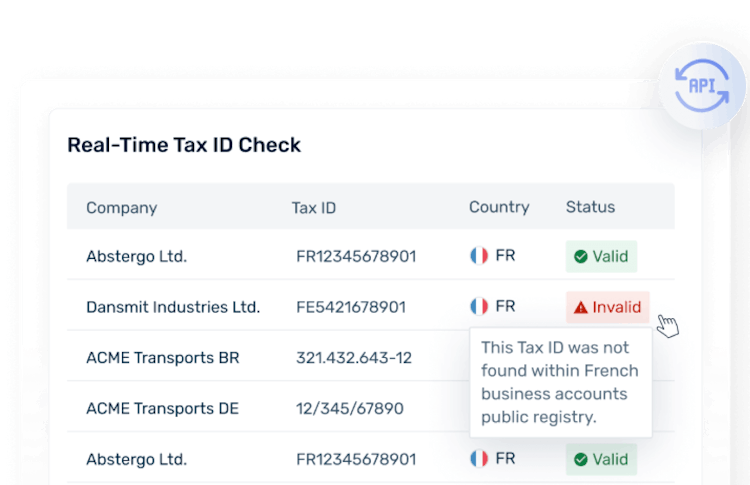

Dutch VAT Number Format

Individuals: Burgerservicenummer (BSN)

- Format: (8 or 9 digits)

Businesses: Omzetbelastingnummer (Ob-nummer) and Btw-identificatienummer (Btw-id)

- Ob-nummer: Tax number used for contacting the Tax and Customs Administration

- Format: (9 digits + the letter B + 2 digits)

- Btw-id: VAT number

- Format: (country code NL + 9 digits + the letter B + 2 digits)

- For individualsFormat: 12345678

- For businessesFormat: 111234567B01

- OtherFormat: NL123456789B01

VAT on Electronically Supplied Services (ESS) in the Netherlands

Digital Services in the European Union (EU) are often referred to as electronically supplied services (ESS). The Netherlands applies the harmonized EU VAT rules for ESS.

- For B2B supplies of such services, the general place of supply rule for services should be taken into consideration.

- For B2C supplies, the EU ESS rules should apply to foreign companies selling to Dutch consumers.

Under the EU’s B2C ESS rules, until the sales value reaches EUR 10,000 (including distance sales of goods), the seller can charge VAT where it is resident. Once the sales exceed the threshold, the seller should register for VAT in The Netherlands, or it can choose to account for the VAT under the EU’s One Stop Shop (OSS) regime.

VAT Rate: 21% VAT is typically applied to the sale of affected electronically supplied services

Will your business need to pay VAT on digital services in the Netherlands in 2024?

Learn More About VAT on Digital Services in the Netherlands

Marketplace & Platform Operator Rules in the Netherlands

The Netherlands applies the harmonized European Union’s (EU) VAT rules for marketplace & platform operators.

Supply of goods

A marketplace is deemed to have received and supplied the goods themselves. This transaction is split into two supplies:

- A supply from the underlying supplier to the marketplace (deemed B2B supply)

- A supply from the marketplace to the final customer (deemed B2C supply).

This rule covers the following:

- Distance sales of goods imported to the EU with a value not exceeding EUR 150

- Supplies of goods to customers in the EU, irrespective of their value, when the underlying supplier is not established in the EU (both domestic supplies and distance sales within the EU are covered).

Supply of services

When electronically supplied services are sold through an intermediary, e.g. a marketplace for applications, the intermediary is deemed to have received and supplied the services themselves. Therefore, the VAT liability shifts to the intermediary from the underlying supplier.

Invoice Requirements in the Netherlands

The following invoice content should be required in the Netherlands:

- Document & general transaction information

- Date of issue

- Date of supply

- Sequential number of the invoice

- Supplier information

- Name, address, and VAT number

- Customer information

- Name, address, and VAT number

- Financial transaction information

- Description of the goods or services

- Quantity

- Unit price excl. VAT

- VAT rate(s)

- VAT amount per rate

- Total amount of the goods or services excl. VAT per rate

- Additional information that may be required:

- Discount if not included in the unit price

- VAT exemption reference

- Reference to reverse charge, self-billing, or special scheme for travel agencies

- Name, address, and VAT number of the fiscal representative

- Advance payments: date of payment if it is different from the invoice date

A simplified invoice should contain the following:

- Date of issue

- Name and address of the supplier

- Description of the goods or services

- VAT amount

E-Invoicing & Digital Reporting for the Netherlands

Business-to-government (B2G) e-invoicing has been mandatory in The Netherlands since 2017. Businesses contracting with the central government should issue e-invoices.

Local authorities may also require suppliers to issue e-invoices.

Learn more about E-Invoicing and Digital Reporting in the Netherlands

Governmental Body Responsible for E-invoicing and Digital Reporting in the Netherlands

The Ministry of the Interior and Kingdom Relations (”Ministerie van Binnenlandse Zaken en Koninkrijksrelaties” (BZK)) is responsible for e-invoicing in The Netherlands.

VAT Payments and Returns in the Netherlands

Full VAT Returns

The Netherlands does not provide simplified VAT returns for VAT-registered non-resident taxpayers supplying qualifying electronically supplied services. Instead, they can avoid VAT registration in The Netherlands and use the EU One-Stop Shop (OSS) return.

Penalties in case of late filings or misdeclarations

In the case of the late filing of VAT returns and payments, the Tax and Customs Authority enforces the following penalties:

Late payment:

- The VAT is paid late, but within the leniency period of 7 days: Official notice.

- The VAT is paid within the leniency period, but it was paid late or not in full in the previous tax period: 3-10% of the VAT due, with a minimum of EUR 50 and a maximum of EUR 5,514.

- The VAT is paid after the leniency period: 3-10% of the VAT due, with a minimum of EUR 50 and a maximum of EUR 5,514.

- If the late payment is caused by negligence, intent, or fraud, the fine can be up to 100% of the VAT due

Late filing:

- Between EUR 68 and EUR 136 per VAT return.

Fonoa does not provide professional tax opinions or tax management advice specific to the facts and circumstances of your business and that your use of the Specification, Site, and In addition, due to rapidly changing tax rates and regulations that require interpretation by your qualified tax professionals, you bear full responsibility to determine the applicability of the output generated by the Specification and Services and to confirm its accuracy. No professional tax opinion and advice. Fonoa does not provide professional tax opinions or tax management advice specific to the facts and circumstances of your business and that your use of the Specification, Site, and In addition, due to rapidly changing tax rates and regulations that require interpretation by your qualified tax professionals, you bear full responsibility to determine the applicability of the output generated by the Specification and Services and to confirm its accuracy.