VAT Guide for Businesses with Customers in Poland

VAT Rates in Poland

The standard VAT rate (Podatek od towarow i uslug (PTU)) in Poland is 23%, with some services exempt from Polish VAT, such as banking and financial transactions. Examples of supplies subject to reduced rates are listed below:

VAT Registration Thresholds in Poland

- VAT registration threshold for domestic established sellers: PLN 200,000 annual turnover

- VAT registration threshold for non-established sellers: No registration threshold

- VAT registration threshold for intra-EU distance selling of goods and B2C telecommunications, broadcasting & electronic services (TBE): PLN 42,000 / EUR 10,000 (net) per calendar year

- VAT registration threshold for non-resident, non-EU based suppliers of electronically supplied services (ESS): No registration threshold

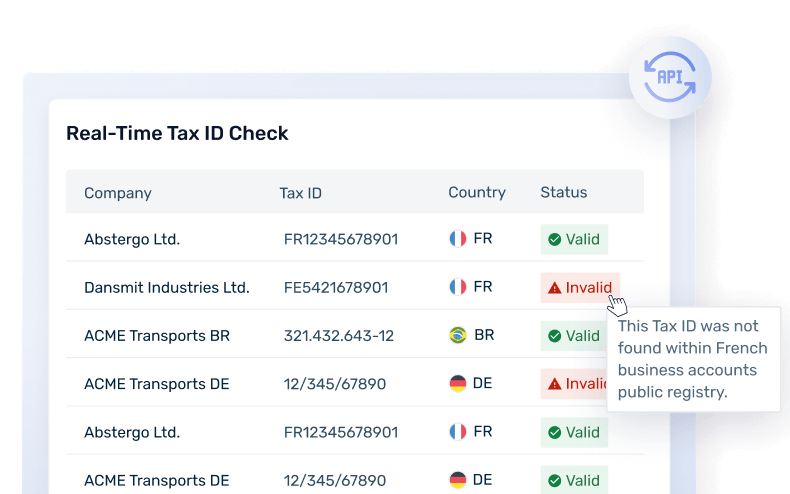

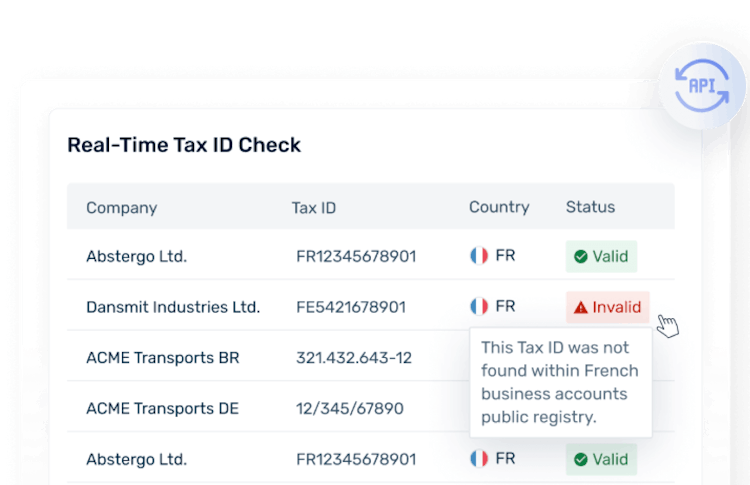

Polish VAT Number Format

Businesses: Numer Identyfikacji Podatkowej (NIP) consist of 10 digits and the PL country code.

Individuals: As of September 1, 2011, Poland recognizes as a tax identification number the PESEL number issued to natural persons registered in the PESEL register and who do not conduct business activity and are not registered for value-added tax purposes. The PESEL number consists of 11 digits.

- For individualsFormat: PL0123456789

- For businessesFormat: 01234567890

VAT on Electronically Supplied Services (ESS) in Poland

Digital Services in the European Union (EU) are often referred to as electronically supplied services (ESS). Poland applies the harmonized EU VAT rules for ESS.

- For B2B supplies of such services, the general place of supply rule for services has to be taken into consideration.

- For B2C supplies, the EU ESS rules should apply to foreign companies selling to Polish consumers (B2C).

Under the EU’s B2C ESS rules, until the sales value reaches EUR 10,000 (including distance sales of goods), the seller can charge VAT where it is resident. Once the sales exceed the threshold, the seller should register for VAT in Poland, or it can choose to account for the VAT under the EU’s One Stop Shop (OSS) regime.

VAT Rate: 23% VAT rate is typically applied to the sale of affected Electronically Supplied Services.

Will your business need to pay VAT on digital services in Poland in 2024?

Learn More About VAT on Digital Services in Poland

Marketplace & Platform Operator Rules in Poland

Poland applies the harmonized European Union’s (EU) VAT rules for marketplace & platform operators.

Supply of goods

A marketplace is deemed to have received and supplied the goods themselves. This transaction is split into two supplies:

- A supply from the underlying supplier to the marketplace (deemed B2B supply)

- A supply from the marketplace to the final customer (deemed B2C supply).

This rule covers the following:

- Distance sales of goods imported to the EU with a value not exceeding EUR 150,

- Supplies of goods to customers in the EU, irrespective of their value, when the underlying supplier is not established in the EU (both domestic supplies and distance sales within the EU are covered).

Supply of services

When electronically supplied services are sold through an intermediary, e.g. a marketplace for applications, the intermediary is deemed to have received and supplied the services themselves. Therefore, the VAT liability shifts to the intermediary from the underlying supplier.

Invoice Requirements in Poland

- Document & general transaction information

- Date of issuance

- Date of the transaction, if different

- A unique sequential number

- Supplier information

- Name, full address, and VAT number

- Customer information

- Name, full address, and VAT number

- Financial transaction information

- Description and breakdown of the goods or services - quantity, discounts, unit price excl. VAT

- Net amount

- The VAT rate(s) applied, and the amount of VAT broken out by rate

- Gross amount

- Additional information that may be required:

- Group VAT number

- VAT exemption reference

- The term “reverse charge” or “self-billing”

- Name, address, and VAT number of the fiscal representative.

E-Invoicing & Digital Reporting for Poland

For B2B transactions, The Polish Ministry of Finance has been working on the introduction of a universal system for sending invoices in an electronic format via KSeF (National e-Invoice System) (Krajowy System e-Faktur; KSeF) for the past few years.

The Polish Ministry of Finance recently enacted the law introducing the obligatory National e-Invoice System (KSeF). The e-Invoicing obligation will take effect on July 1, 2024. However, this requirement will begin on January 1, 2025, for small and medium-sized enterprises exempt from VAT. KSeF platform is already available for taxpayers who wish to adopt e-invoicing voluntarily.

Under the National e-Invoice system (KSeF system), taxpayers will prepare invoices in their own ERP systems and send them via API to the KSeF. In the KSeF, each invoice will receive a timestamp and a unique identification number. Invoices to consumers (B2C) will not be covered by the KSeF.

Poland introduced the Standard Audit File for Tax (SAF-T; in Polish Jednolity Plik Kontrolny - JPK) on July 1, 2016, for large taxpayers. It became compulsory for all taxpayers in January 2018. SAF-T replaced VAT returns in Poland from 1 October 2020.

Learn more about E-Invoicing and Digital Reporting in Poland

Governmental Body Responsible for E-invoicing and Digital Reporting in Poland

The Ministry of Finance is responsible for e-invoicing in Poland.

VAT Payments and Returns in Poland

Full VAT Returns

Penalties in case of late filings or misdeclarations

In the case of the late filing of SAF-T returns and payments, the Polish Tax Authority/government enforces the following penalties:

- Penalties for late payment and filings

- The Tax Authorities may impose on a taxable person a disciplinary sanction for non-filing or late filing of VAT returns, recapitulative statements or SAF-T files. The disciplinary sanction amounts to PLN 2,800 per return or file.

- The interest rate applied to delayed payments of VAT is the sum of 200% of the National Bank of Poland's “Lombard rate” and 2%. The standard interest rate is 12% per year.

- Penalties for errors

- A penalty of 30% is charged for the understatement of tax liability, if it is shown in the tax return that the amount of tax is lower than the amount payable or overstatement of the amount of input tax.

Fonoa does not provide professional tax opinions or tax management advice specific to the facts and circumstances of your business and that your use of the Specification, Site, and In addition, due to rapidly changing tax rates and regulations that require interpretation by your qualified tax professionals, you bear full responsibility to determine the applicability of the output generated by the Specification and Services and to confirm its accuracy. No professional tax opinion and advice. Fonoa does not provide professional tax opinions or tax management advice specific to the facts and circumstances of your business and that your use of the Specification, Site, and In addition, due to rapidly changing tax rates and regulations that require interpretation by your qualified tax professionals, you bear full responsibility to determine the applicability of the output generated by the Specification and Services and to confirm its accuracy.