VAT Guide for Businesses with Customers in Portugal

VAT Rates in Portugal

There are three separate regions that fall within the Portugese VAT (”Imposto sobre Valor Acrescentado” (IVA)) regime - mainland Portugal, the Madeira archipelago, and the Azores. Rates levied in these regions are different.

The following are exempt from VAT within Portugal and the autonomous regions:

- provision of medical services and education or professional training;

- the transfer and leasing of real estate;

- certain provision of services carried out by non-profit organizations;

- certain financial transactions

VAT Registration Thresholds in Portugal

- VAT registration threshold for domestic established sellers: EUR 13,500 (net) Starting from 2023, the threshold has been set at EUR 13,500, with conditions for businesses that started activities in 2022. In 2024, the threshold will be increased to EUR 14,500, and in 2025 it will be increased once again to EUR 15,000.

- VAT registration threshold for non-established sellers: No registration threshold

- VAT registration threshold for intra-EU distance selling of goods and B2C telecommunications, broadcasting & electronic services (TBE): EUR 10,000 (net) per calendar year

- VAT registration threshold for non-resident, non-EU based suppliers of Electronically Supplied Services (ESS): No registration threshold

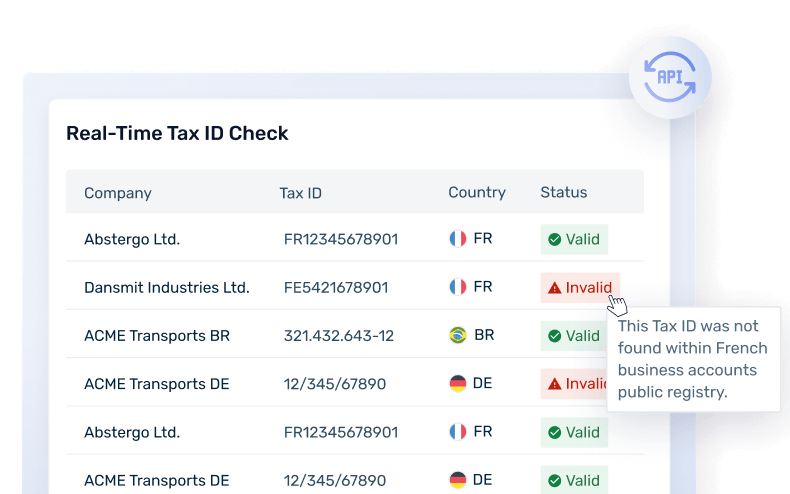

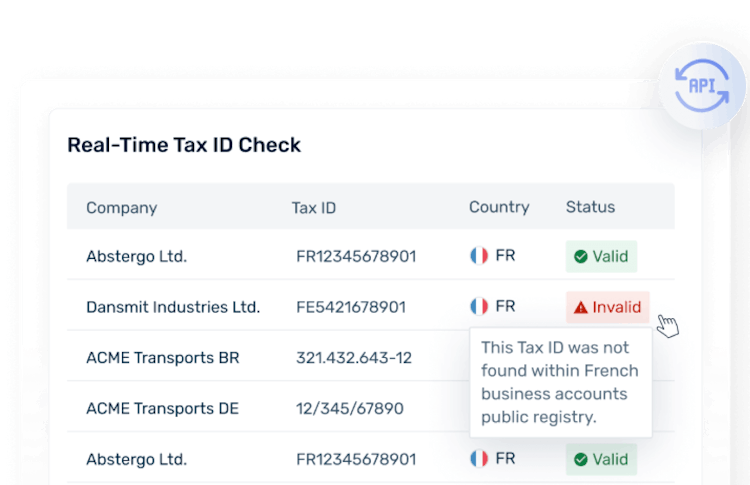

Portuguese VAT Number Format

Individuals: The Taxpayer Individual Number (”Número de Identificação Fiscal” (NIF)) is composed of nine digits.

Businesses: The NIF for businesses is referred to as the NIPC (”Número de Identificação de Pessoa Colectiva”). This number is also comprised of nine digits.

- For individualsFormat: 123456789

- For businessesFormat: 564111132

- OtherFormat: PT 564111132

VAT on Electronically Supplied Services (ESS) in Portugal

Digital Services in the European Union (EU) are often referred to as electronically supplied services (ESS). Portugal applies the harmonized EU VAT rules for ESS.

- For the B2B supplies of such services, the general place of supply rule for services has to be considered.

- For B2C supplies, the EU ESS rules should apply to foreign companies selling to Portuguese consumers.

Under the EU’s B2C ESS rules, until the sales value reaches EUR 10,000 (including distance sales of goods), the seller can charge VAT where it is resident. Once the sales exceed the threshold, the seller should register for VAT in Portugal, or it can choose to account for the VAT under the EU’s One Stop Shop (OSS) regime.

VAT Rate: Standard rate of 23% is typically applied in mainland Portugal, 22% Madeira, and 16% in the Azores should typically be applied to the sale of affected electronically supplied services

Will your business need to pay VAT on digital services in Portugal in 2024?

Learn More About VAT on Digital Services in Portugal

Marketplace & Platform Operator Rules in Portugal

Portugal applies the harmonized European Union’s (EU) VAT rules for marketplace & platform operators.

Supply of goods

A marketplace is deemed to have received and supplied the goods themselves. This transaction is split into two supplies:

- A supply from the underlying supplier to the marketplace (deemed B2B supply)

- A supply from the marketplace to the final customer (deemed B2C supply).

This rule covers the following:

- Distance sales of goods imported to the EU with a value not exceeding EUR 150

- Supplies of goods to customers in the EU, irrespective of their value, when the underlying supplier is not established in the EU (both domestic supplies and distance sales within the EU are covered).

Supply of services

When electronically supplied services are sold through an intermediary, e.g. a marketplace for applications, the intermediary is deemed to have received and supplied the services themselves. Therefore, the VAT liability shifts to the intermediary from the underlying supplier.

Invoice Requirements in Portugal

Invoices should be dated, numbered sequentially, and contain the following information, at a minimum:

- Document & general transaction information

- ATCUD - the document's unique code

- The date on which the goods were made available to the purchaser, or the date on which the services were carried out, or on which payments were made prior to carrying out the operations if that date does not coincide with the date on which the invoice was issued

- QR Code

- Supplier information

- The name, business name, or company name and the head office or domicile of the supplier of goods or service provider, as well as the corresponding TIN

- Customer information

- The name, business name, or company name and the head office or domicile of the recipient or acquirer subject to tax, as well as the corresponding TIN

- Financial transaction information

- The quantity and usual name of the goods transferred or services provided, specifying the elements necessary to determine the applicable fee. Packaging not actually traded should be subject to a separate indication and with express mention that its return has been agreed

- The price, excluding VAT, and the other elements included in the taxable amount

- The applicable VAT rates and the amount of tax due

- The justification for the non-application of the tax, if applicable

- Additional information that may be required:

- In cases where taxable persons do not have a registered office, permanent establishment, or domicile in Portugal and have appointed a Tax Representative, the invoices should also contain the name or corporate name and the registered office, permanent establishment or domicile of the representative, as well as the respective tax identification number.

Invoices may, subject to acceptance by the recipient, be issued electronically.

E-Invoicing & Digital Reporting for Portugal

In terms of digital reporting, the obligation to submit invoice data electronically began in 2013.

Taxable persons (both resident and non-resident) with an annual turnover above EUR 50.000 should use invoicing software certified by the Tax Authority to transmit invoicing data to the Tax Authority portal and generate supporting documents.

Digital Reporting obligations for taxable persons in Portugal consist of:

- Electronic transmission of invoice data which can be done by one of three available methods:

- By electronic transmission of documents and data in real-time

- By electronic transmission of data, by sending a standardized file structured based on the SAF-T (PT) file

- Export of the SAFT-PT file to the Tax Authority portal

- Mandatory obligation to create and export a SAFT-PT accounting file at the request of the tax authority. From 2025, this file should be exported and submitted to the tax authority annually. This means that the first mandatory submission will be April 2026 relating to the records for FY 2025.

- Electronic communication of data related to transport documents.

It is mandatory to generate electronic invoices for B2G transactions in Portugal, however this obligation does not exist for B2B and B2C transactions. Electronic invoicing in public procurement was initially intended to enter into force on January 1, 2019. The timeline has been updated several times due to the complexity of the project, and then the COVID-19 pandemic.

After the implementation of B2G e-invoicing for large taxpayers, the last phase covering small&medium-sized companies and micro-enterprises will go live on January 1, 2025.

After these changes, all entities should generate e-invoices in the approved standard format – CIUS-PT when supplying services to public entities.

Following the recent latest legal changes, PDF invoices will be considered as electronic invoices for all tax related purposes until December 31, 2024.

Learn more about E-Invoicing and Digital Reporting in Portugal

Governmental Body Responsible for E-invoicing and Digital Reporting in Portugal

The governmental body responsible for the digital reporting of invoice data is the Portuguese Tax and Customs Authority.

Most governmental entities receive e-invoices through the FE-AP (Electronic Invoice Portal).

VAT Payments and Returns in Portugal

Companies and self-employed workers should submit a periodic declaration to pay Value Added Tax (IVA) due in Portugal.

The periodic declaration should be submitted:

- Quarterly, for companies or self-employed workers with a turnover below EUR 650, 000 in the previous calendar year

- Monthly, for companies or self-employed workers with a turnover equal to or greater than EUR 650,000 in the previous calendar year

Full VAT Returns

Penalties in case of late filings or misdeclarations

In the case of the late filing of VAT returns and payments, the Portuguese Tax Authority should enforce the following penalties:

Fines for non-delivery of VAT are calculated based on the amount owed, but have a minimum value of EUR 25. They are provided in the RGIT (General Regime of Tax Infringements).

Fine for the delay due to negligence:

- Natural person: fine of 15% to 50% of the missing tax (maximum of EUR 22,500)

- Legal person: fine of 30% to 100% of the missing tax (maximum of EUR 45,000)

Fine for the culpable delay, up to 90 days:

- Natural person: fine of 100% to 200% of the outstanding tax (maximum of EUR 82,000)

- Legal person: fine of 200% to 400% of the missing tax (maximum of EUR 165,000)

Fonoa does not provide professional tax opinions or tax management advice specific to the facts and circumstances of your business and that your use of the Specification, Site, and In addition, due to rapidly changing tax rates and regulations that require interpretation by your qualified tax professionals, you bear full responsibility to determine the applicability of the output generated by the Specification and Services and to confirm its accuracy. No professional tax opinion and advice. Fonoa does not provide professional tax opinions or tax management advice specific to the facts and circumstances of your business and that your use of the Specification, Site, and In addition, due to rapidly changing tax rates and regulations that require interpretation by your qualified tax professionals, you bear full responsibility to determine the applicability of the output generated by the Specification and Services and to confirm its accuracy.