VAT Guide for Businesses with Customers in Saudi Arabia

VAT Rates in Saudi Arabia

The standard VAT rate (”ضريبة القيمة المضافة”) in the Kingdom of Saudi Arabia (KSA) is 15%. Some services, such as certain financial services, are exempt from Saudi Arabian VAT.

*GCC stands for The Cooperation Council for the Arab States of the Gulf

VAT Registration Thresholds in Saudi Arabia

- VAT registration threshold for domestic established sellers: if the total amount of taxable supplies exceeds SAR 375,000 in the past 12 consecutive months or is expected to exceed this amount in the next 12 months

- VAT registration threshold for non-established sellers: No threshold

- VAT registration threshold for non-resident suppliers of Digital Services: No threshold

Learn more about VAT on Digital Services in Saudi Arabia

Saudi Arabian VAT Number Format

Businesses have a VAT number, which is a 15-digit identifier that ZATCA (Zakat, Tax and Customs Authority of the Kingdom of Saudi Arabia) issues to all taxpayers and withholding entities.

- The (first digit) is the GCC Member State.

- The (next eight digits) are a serial number.

- The next digit is a check digit.

- The (next 3 digits) are the taxpayer's subsidiaries.

- The (next and last 2 digits) are the tax type.

Private individuals have a 12-digit personal tax identification number (TIN). The first two digits represent the individual's region of residence and the next 10 digits are a unique identification number assigned to the individual by ZATCA.

In Saudi Arabia, the personal tax identification number (TIN) is referred to as the "National ID" (رقم الهوية الوطنية) or "Iqama" (الإقامة) in Arabic.

- For businessesFormat: 123456789012345

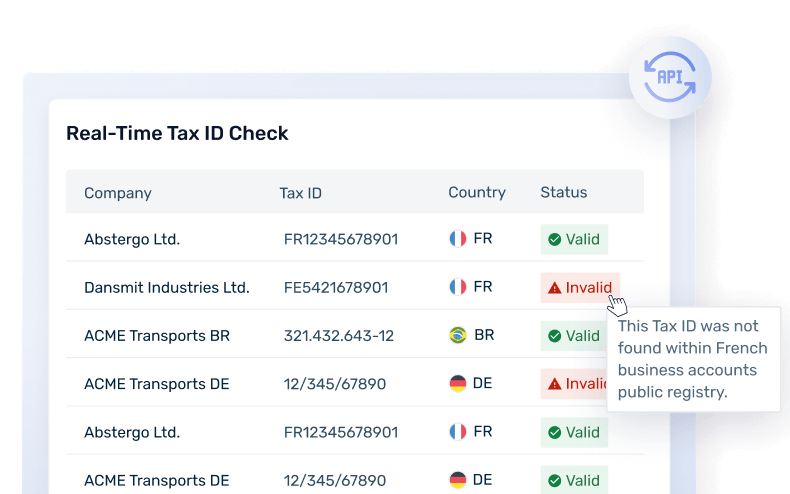

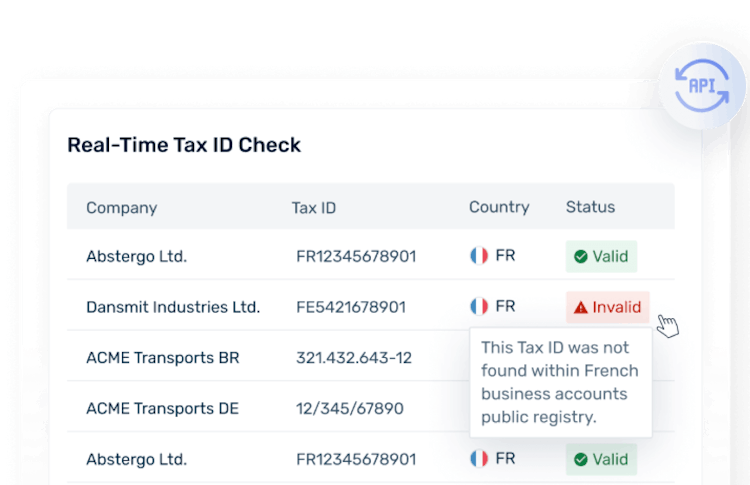

Saudi Arabia VAT ID Validation

Need to look up and validate VAT numbers in Saudi Arabia?

Explore Lookup

VAT on Digital Services in Saudi Arabia

KSA imposes value-added tax on non-resident providers of Electronic or Digital Services (also known as Electronically Supplied Services) to consumers. In such a case, the non-resident provider should register for VAT and request a VAT number from ZATCA. This is not to be confused with Digital Services Taxes (DST) which is an entirely different tax and does not exist in the KSA.

Tax Rate: 15% VAT applied to the sale of affected digital services

Taxable digital services in the Kingdom of Saudi Arabia

- Any service relating to the transmission, emission, or reception of signals, writing, images, sounds, or information of any nature by wire, radio, optical, or other electromagnetic systems;

- The transfer or assignment of the right to use capacity for such transmission, emission, or reception;

- The provision of access to global information networks;

- The provision of audio and audio-visual content for listening or viewing by the general public on the basis of the program schedule by a person that has editorial responsibility;

- Live streaming via the internet;

- Supplies of images or text provided electronically, such as photos, screensavers, electronic books, and other digitized documents or files;

- Supplies of music, films, and games and of programs on demand;

- Online magazines;

- Website supply or web hosting services;

- Distance maintenance of programs and equipment;

- Supplies of software and software updates;

- Advertising space on a website and any right associated with such advertising.

Will your business need to pay VAT on digital services in Saudi Arabia in 2024?

Learn More About VAT on Digital Services in Saudi Arabia

Marketplace & Platform Operator Rules in Saudi Arabia

An electronic platform or marketplace that connects Saudi Arabian buyers not registered for VAT with non-resident suppliers should follow special rules for providing Digital Services. The electronic platform may be considered the supplier for VAT purposes if:

- the non-resident supplier is not explicitly identified during the online sale process and on the invoice to the buyer;

- the electronic intermediary authorizes the charge to the buyer themselves; or

- the electronic intermediary is setting the terms and conditions of the supply.

If the online interface or portal operator acts on behalf of a non-resident supplier, it will be deemed to purchase the services from the non-resident supplier, then subsequently make a separate supply of the same services to the KSA customer.

Invoice Requirements in Saudi Arabia

A tax invoice should be issued in Arabic (in addition to any other language shown on the invoice) and should include the following information:

- Document & general transaction information

- The invoice issuance date

- Unique invoice sequential number

- Date of performance (if it differs from the invoice issuance date)

- Supplier information

- Name, address, and Tax ID number

- Customer information

- Name and address

- If the customer is required to assess and report the VAT, the Customer’s tax ID number and a statement on this requirement

- Financial transaction information

- The quantity and nature of the goods supplied, or the scope and nature of the services rendered

- The taxable amount per rate or exemption, the unit price exclusive of VAT, and any discounts or rebates if they are not included in the unit prices

- VAT rate

- The amount of VAT payable in SAR

- Additional information that may be required

- In cases where VAT is not charged at the standard rate, the invoice shall include an explanation of the tax treatment applied to the supply; and

- In cases where the profit margin method for Eligible Used Goods is applied, reference to the fact that VAT is charged on the profit on those Eligible Used Goods.

The tax invoice should be issued no later than the fifteenth day of the month following the month in which the supply took place. A tax invoice is usually issued for B2B and B2G transactions. This type of document is used for claiming input VAT deduction by buyers.

In Phase 1 - at the Generation Phase - from December 3, 2021, until December 31, 2023, no specific format is required to issue an invoice. From the beginning of Phase 2 - at the Integration Phase -, which starts on January 1, 2023, XML format or PDF/A-3 format is mandatory.

A simplified tax invoice is generally issued for B2C transactions. However, a taxpayer may issue a simplified tax invoice in a B2B transaction if the value of taxable supply is less than 1,000 SAR (approximately EUR 250).

A simplified tax invoice should include the following information:

- The invoice issuance date;

- The name, address, and tax ID number of the supplier;

- A description of the goods and services supplied;

- The consideration payable for the goods and services;

- The tax payable or a statement that the consideration is inclusive of tax in respect of the supply of the goods or services.

The simplified tax invoice shall be issued at the date of performance or the date of receipt of consideration, whatever comes earlier. If the simplified tax invoice contains the customer’s name, address, and date of performance, the simplified tax invoice should be issued no later than the fifteenth day of the month following the month in which the supply took place.

Electronic Credit & Debit notes are issued after the issuance of Tax Invoices and Simplified Tax Invoices, wherein the transaction is adjusted. Credit and Debit notes should include a reference to the original invoice(s) to which they are issued.

E-Invoicing & Digital Reporting for Saudi Arabia

The E-Invoicing & Reporting System entered into force in two phases:

- First Phase - the Generation Phase. Issuing e-invoices became mandatory in the First Phase starting December 4, 2021. The First Phase includes the rules for the generation of e-invoices and e-notes, as well as provisions related to its processing and record keeping. The aim of this Phase is to eliminate the generation of handwritten invoices or computer-generated invoices through text editing software.

- Second Phase - the Integration Phase. Taxpayers should integrate their systems into ZATCA’s system and are obliged to transfer the e-invoices and notes to ZATCA in the Second Phase. This Phase started on January 1, 2023.

The First Phase: E-invoicing

Any taxable person that is resident in KSA or registered for VAT in Saudi Arabia and any customer or third party that issues a tax invoice on behalf of a resident taxable person should issue electronic invoices in respect of all their transactions containing KSA VAT.

The Second Phase: Digital Reporting

Phase 2 is divided into waves.

- The first wave starts from January 1, 2023, and affects taxpayers whose VATable revenue for 2021 exceeded 3 billion SAR (approximately USD 800 million).

- The second wave starts from July 1, 2023, and affects taxpayers whose VATable revenue for 2021 exceeded half a billion SAR (approximately USD 133 million).

- The third wave : According to the announcement of the Zakat, Tax and Customs Authority (ZATCA), the third wave of the Phase 2 e-invoicing (Integration phase) will affect all taxpayers whose revenues subject to VAT exceeded 250 million SAR (approximately 67 million USD) during 2021 or 2022. Affected businesses should integrate their e-invoicing solutions with ZATCA’s e-invoicing (FATOORA) platform starting from October 1, 2023.

- The fourth wave: The fourth phase affects all taxpayers whose revenues subject to VAT exceeded SAR 150 Million (~USD 40 Million) during 2021 or 2022. VAT-registered taxpayers meeting the criteria should integrate their e-invoicing solutions with (FATOORA) Platform from November 1, 2023, until February 29, 2024.

- The fifth wave: The fifth phase affects all taxpayers whose revenues subject to VAT exceeded SAR 100 Million (~USD 27 Million) during 2021 or 2022. VAT-registered taxpayers meeting the criteria should integrate their e-invoicing solutions with (FATOORA) Platform from December 1, 2023, until March 30, 2024.

- The sixth wave: The sixth phase affects all taxpayers whose revenues subject to VAT exceeded SAR 70 Million (~USD 19 Million) during 2021 or 2022. VAT-registered taxpayers meeting the criteria should integrate their e-invoicing solutions with (FATOORA) Platform from January 1, 2024, until April 30, 2024.

- The seventh wave: The seventh phase includes all taxpayers whose revenues subject to VAT exceed SAR 50 Million (~USD 13 Million) during 2021 or 2022. VAT-registered taxpayers meeting the criteria should integrate their e-invoicing solutions with the FATOORA Platform starting from February 1, 2024 until May 31, 2024.

- The eighth wave: The eighth wave included all taxpayers whose revenues subject to VAT exceed SAR 40 Million (~USD 10.5 Million) during 2021 or 2022. VAT-registered taxpayers meeting the criteria should integrate their e-invoicing solutions with the FATOORA Platform starting from March 1, 2024 until June 31, 2024.

- The ninth wave: The ninth wave includes all taxpayers whose revenues subject to VAT exceed SAR 30 Million (~USD 8 Million) during 2021 or 2022. VAT-registered taxpayers meeting the criteria should integrate their e-invoicing solutions with the FATOORA Platform starting from June 1, 2024.

ZATCA notifies taxpayers individually, and upon this notification, each taxpayer has six months to comply with the integration phase requirements. Compliance timelines will, therefore, vary for each taxpayer depending on the receipt of the notification.

Clearance is required for all the B2B and B2G e-invoices on a real-time basis via APIs before they can be shared with the buyers or customers. This also covers respective debit notes and credit notes.

For B2C transactions, the simplified e-invoices (including their respective debit and credit notes) should be reported to the authorities within 24 hours of their generation and shared with intended customers.

Learn more about E-Invoicing in Saudi Arabia

Governmental Body Responsible for E-invoicing and Digital Reporting in Saudi Arabia

Zakat, Tax and Customs Authority of Saudi Arabia (ZATCA) (in Arabic: هيئة الزكاة والضريبة والجمارك) ****is the governmental body tasked with regulating, enforcing, administering, and implementing taxation in the Kingdom of Saudi Arabia.

ZATCA operates an online platform for e-invoicing purposes named Fatoora Platform, through which tax invoices, simplified tax invoices, and electronic credit/debit note data are received.

VAT Payments and Returns in Saudi Arabia

All businesses with a Saudi VAT number should submit periodic VAT returns and payments. Online VAT return forms will be available in the taxpayer’s account on the first day of every filing period. VAT returns shall be filed by the taxable person or a person authorized to act on his behalf.

The filing frequency depends on the annual value of the taxpayer’s taxable supplies. Taxpayers with over SAR 40 million in turnover annually should file their tax returns monthly. Taxpayers under this threshold should file their tax returns quarterly. However, taxpayers may opt for the monthly filing frequency.

Full VAT Returns

Penalties in case of late filings or misdeclarations

In the case of the late filing of VAT returns and payments, ZATCA enforces the following penalties:

- The tax penalty in case of incorrect tax return filing, which results in a tax shortage, is 50% of the value of the difference between the calculated VAT and the VAT due.

- The tax penalty in case of failing to submit a VAT return within the due date is not less than 5% but cannot exceed 25% of the value of the VAT that would have had to be declared.

- If a taxpayer fails to pay the VAT within the due date, 5% of the value of the unpaid VAT should be paid as a penalty.

- Tax evasion is punished by a penalty of not less than the amount of VAT due, but cannot exceed three times the value of the goods or services subject to tax evasion. An example of tax evasion would be submitting false documents to evade the VAT payment due or reduce its value.

- A person who fails to apply for VAT registration shall be fined SAR 10,000.

- A penalty of SAR 50,000 shall be paid for violating the archiving rules.

- Moving goods in or out of the Kingdom without paying the VAT due is punished with at least the amount of the VAT due and up to three times the value of the goods.

- When a non-registered person issues a VAT invoice and, as a result, collects VAT, they shall be fined up to SAR 100,000.

- Preventing tax officers from performing their duties results in a maximum penalty of SAR 50,000.

- Violating any other provision of the VAT regulations or the VAT law will result in a maximum penalty of SAR 50,000.

If the taxpayer violates the same rule within three years from the date of issuing the final decision of a previous penalty, the penalty may be doubled.

Fonoa does not provide professional tax opinions or tax management advice specific to the facts and circumstances of your business and that your use of the Specification, Site, and In addition, due to rapidly changing tax rates and regulations that require interpretation by your qualified tax professionals, you bear full responsibility to determine the applicability of the output generated by the Specification and Services and to confirm its accuracy. No professional tax opinion and advice. Fonoa does not provide professional tax opinions or tax management advice specific to the facts and circumstances of your business and that your use of the Specification, Site, and In addition, due to rapidly changing tax rates and regulations that require interpretation by your qualified tax professionals, you bear full responsibility to determine the applicability of the output generated by the Specification and Services and to confirm its accuracy.