VAT Guide for Businesses with Customers in Slovenia

VAT Rates in Slovenia

The standard Value Added Tax (”Davek na dodano vrednost” (DDV)) rate in Slovenia is 22%, with some services exempt from Slovenian VAT, such as financial services or specific real estate transactions.

VAT Registration Thresholds in Slovenia

- VAT registration threshold for domestic established sellers: EUR 50,000. Taxpayers who only make supplies that are exempt from VAT should not be required to register.

- VAT registration threshold for non-established sellers: No registration threshold

- VAT registration threshold for intra-EU distance selling of goods and B2C telecommunications, broadcasting & electronic services (TBE): EUR 10,000 (net) per calendar year

- VAT registration threshold for non-resident, non-EU based suppliers of Electronically Supplied Services (ESS): No registration threshold

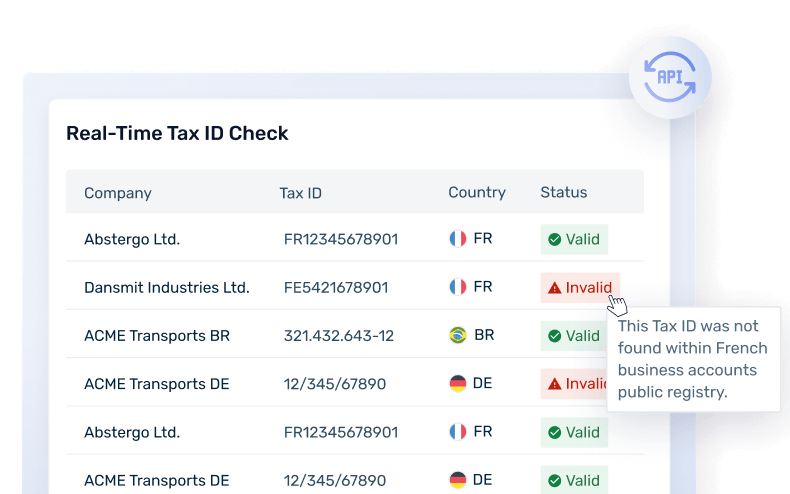

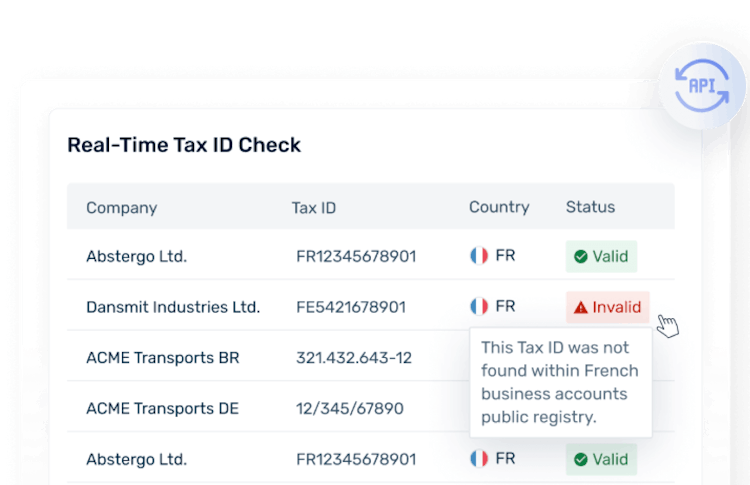

Slovenian VAT Number Format

Individuals: “Davčna številka (Tax number)

Businesses: Identifikacijska številka za DDV (VAT number)

- For individualsFormat: 12345678

- For businessesFormat: SI87654321

VAT on Electronically Supplied Services (ESS) in Slovenia

Digital Services in the European Union (EU) are often referred to as electronically supplied services (ESS). Slovenia applies the harmonized EU VAT rules for ESS.

- For B2B supplies of such services, the general place of supply rule for services has to be taken into consideration.

- For B2C supplies, the EU ESS rules should apply to foreign companies selling to Slovenian consumers.

Under the EU’s B2C ESS rules, until the sales value reaches EUR 10,000 (including distance sales of goods), the seller can charge VAT where it is resident. Once the sales exceed the threshold, the seller should register for VAT in Slovenia, or it can choose to account for the VAT under the EU’s One Stop Shop (OSS) regime.

VAT Rate: 22% VAT is typically applied to the sale of affected electronically supplied services

Will your business need to pay VAT on digital services in Slovenia in 2024?

Learn More About VAT on Digital Services in Slovenia

Marketplace & Platform Operator Rules in Slovenia

Slovenia applies the harmonized European Union’s (EU) VAT rules for marketplace & platform operators.

Supply of goods

A marketplace is deemed to have received and supplied the goods themselves. This transaction is split into two supplies:

- A supply from the underlying supplier to the marketplace (deemed B2B supply)

- A supply from the marketplace to the final customer (deemed B2C supply).

This rule covers the following:

- Distance sales of goods imported to the EU with a value not exceeding EUR 150

- Supplies of goods to customers in the EU, irrespective of their value, when the underlying supplier is not established in the EU (both domestic supplies and distance sales within the EU are covered).

Supply of services

When electronically supplied services are sold through an intermediary, e.g. a marketplace for applications, the intermediary is deemed to have received and supplied the services themselves. Therefore, the VAT liability shifts to the intermediary from the underlying supplier.

Invoice Requirements in Slovenia

According to the Slovenian VAT Act, invoices should contain the following information:

- Document & general transaction information

- Date of issue

- Sequential number of the invoice

- Date of supply if it is different from the date of issue

- Supplier information

- Name, address, and VAT number

- Customer information

- Name and address

- VAT number if it is liable to pay the VAT

- Financial transaction information

- Description of the goods or services

- Quantity

- Unit price excl. VAT

- VAT rate(s)

- VAT amount

- Total amount of the goods or services excl. VAT per rate

- Additional information that may be required:

- VAT exemption reference

- Reference to reverse charge, self-billing, or special scheme for travel agencies

A simplified invoice should contain the following:

- Date of issue

- Sequential number of the invoice

- Name, address, and VAT number of the supplier

- Description of the goods or services

- VAT amount

E-Invoicing & Digital Reporting for Slovenia

Business-to-government (B2G) e-invoicing has been mandatory in Slovenia since 2015.

Learn more about E-Invoicing and Digital Reporting in Slovenia

Governmental Body Responsible for E-invoicing and Digital Reporting in Slovenia

The Administration of the Republic of Slovenia for Public Payments (”Uprava za javna plačila” (UJP)) is responsible for e-invoicing in Slovenia.

VAT Payments and Returns in Slovenia

Full VAT Returns

Slovenia does not provide simplified VAT returns for VAT-registered non-resident taxpayers supplying qualifying electronically supplied services. Instead, they can avoid VAT registration in Slovenia and use the EU One-Stop Shop (OSS) return.

Penalties in case of late filings or misdeclarations

In the case of the late filing of VAT returns and payments, the Slovenian Financial Administration (Finančna Uprava) enforces the following penalties:

- A penalty between EUR 4,000 and EUR 125,000 may be imposed depending on the size of the taxpayer and the gravity of the offense.

- A default interest rate of 3% is imposed for late payment of VAT. If the tax liability is established during a tax audit, the interest rate should be 7%.

Fonoa does not provide professional tax opinions or tax management advice specific to the facts and circumstances of your business and that your use of the Specification, Site, and In addition, due to rapidly changing tax rates and regulations that require interpretation by your qualified tax professionals, you bear full responsibility to determine the applicability of the output generated by the Specification and Services and to confirm its accuracy. No professional tax opinion and advice. Fonoa does not provide professional tax opinions or tax management advice specific to the facts and circumstances of your business and that your use of the Specification, Site, and In addition, due to rapidly changing tax rates and regulations that require interpretation by your qualified tax professionals, you bear full responsibility to determine the applicability of the output generated by the Specification and Services and to confirm its accuracy.