VAT Guide for Businesses with Customers in Spain

VAT Rates in Spain

The standard Value Added Tax (Impuesto sobre el Valor Añadido (IVA)) rate in Spain is 21%, with some services exempt from Spain VAT, such as the supply of health, veterinary and education services for children and adolescents

VAT (Impuesto sobre la Producción, los Servicios y la Importación (IPSI)) rates in Ceuta

- Supply of goods

- 0.5% (Standard Rate)

- 3%, 5%, and 10% (Increased Rates)

- Supply of services

- 4% (Standard Rate)

- 0.5%, 1%, and 2% (Reduced Rates)

- 6%, 9%, and 10% (Increased Rates)

VAT (Impuesto sobre la Producción, los Servicios y la Importación (IPSI)) rates in Melilla

- Supply of goods

- 0.5% (Standard Rate)

- 3%, 4%, 5%, 7%, and 10% (Increased Rates)

- Supply of services

- 4% (Standard Rate)

- 0.5%, 1%, and 2% (Reduced Rates)

- 8% (Increased Rate)

VAT (Impuesto General Indirecto Canario (IGIC)) rates in The Canary Islands

- Both goods and services

- 7% (Standard Rate)

- 3% (Reduced Rate)

- 0% (Zero Rate)

- 9.5%, 15%, and 20% (Increased Rates)

VAT Registration Thresholds in Spain

- VAT registration threshold for domestic established sellers: No registration threshold

- VAT registration threshold for non-established sellers: No registration threshold

- VAT registration threshold for intra-EU distance selling of goods and B2C telecommunications, broadcasting & electronic services (TBE): EUR 10,000 (net) per calendar year

- VAT registration threshold for non-resident, non-EU based suppliers of Electronically Supplied Services (ESS): No registration threshold

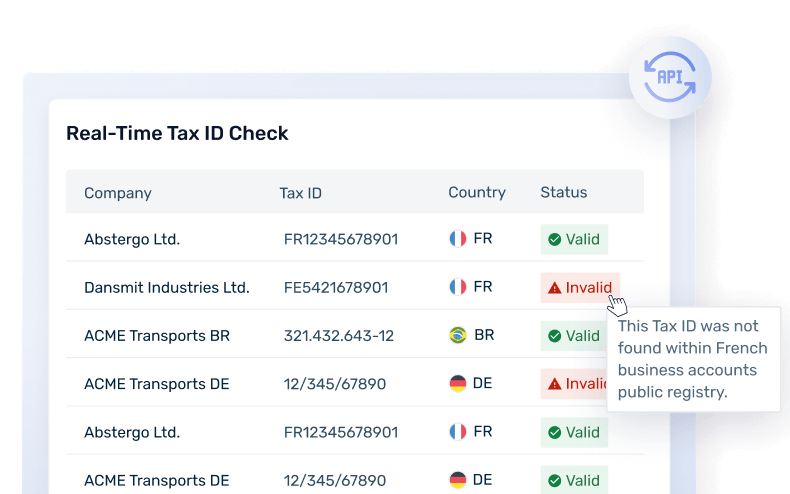

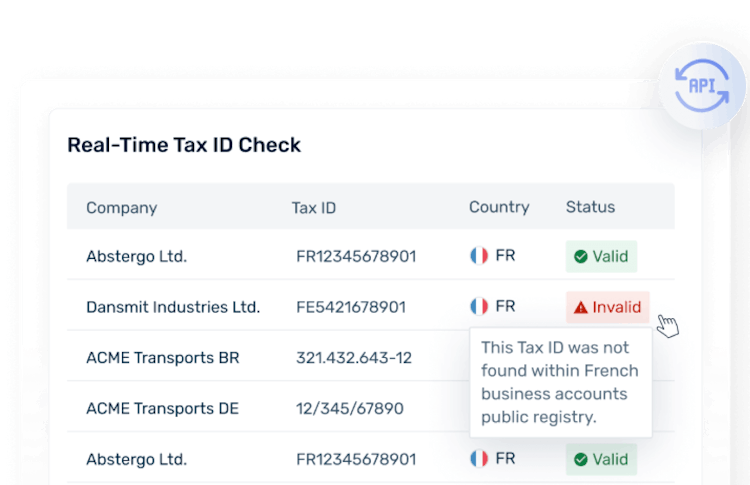

Spanish VAT Number Format

Individuals and companies registered for VAT have a Fiscal Identification Number (NIF). In both cases, the NIF consists of 9 digits.

- Individual NIF structure

- Format: For residents in Spain, the NIF is the Spanish ID (DNI - National Identity Document), which consists of an eight-digit number and a control character. For non-residents in Spain, the NIF consists of a letter indicating status, a seven-digit number, and a control character (i.e. L1234567A). The meaning of the first code letter is as follows:

- “L” - Spanish nationals resident abroad who are not required to have a national identity card

- “M” - individuals who do not have Spanish nationality and do not have a foreigner's identity number, either temporarily because they are obliged to have one, or definitively because they are not obliged to have one

- Format: For residents in Spain, the NIF is the Spanish ID (DNI - National Identity Document), which consists of an eight-digit number and a control character. For non-residents in Spain, the NIF consists of a letter indicating status, a seven-digit number, and a control character (i.e. L1234567A). The meaning of the first code letter is as follows:

- Business NIF structure

- Format: The NIF consists of a letter indicating the legal form of a Spanish organization or, where applicable, the nature of a foreign organization or permanent establishment established outside Spain, a seven-digit number, and a control character. The meaning of the first code letter is as follows:

- A Public limited companies

- B Limited liability companies

- C Commercial partnerships

- D Limited partnerships

- E Unincorporated firms and other entities without legal personality not specifically covered by other codes

- F Cooperative societies

- G Associations

- H Residents' associations under the horizontal property regime

- J Civil associations

- N Foreign entities without a permanent establishment

- P Local companies

- Q Public institutions

- R Religious communities and institutions

- S State Administration and Autonomous Community Institutions

- U Temporary consortia and joint ventures

- V Other types not defined in the other codes

- W Permanent establishments of entities not resident on Spanish territory

- Format: The NIF consists of a letter indicating the legal form of a Spanish organization or, where applicable, the nature of a foreign organization or permanent establishment established outside Spain, a seven-digit number, and a control character. The meaning of the first code letter is as follows:

- For individualsFormat: L1234567A

- For businessesFormat: A1234567A

VAT on Electronically Supplied Services (ESS) in Spain

Digital Services in the European Union (EU) are often referred to as electronically supplied services (ESS). Spain applies the harmonized EU VAT rules for ESS.

- For B2B supplies of such services, the general place of supply rule for services has to be taken into consideration.

- For B2C supplies, the EU ESS rules should apply to foreign companies selling to Spain consumers (B2C).

Under the EU’s B2C ESS rules, until the sales value reaches EUR 10,000 (including distance sales of goods), the seller can charge VAT where it is resident. Once the sales exceed the threshold, the seller should register for VAT in Spain, or it can choose to account for the VAT under the EU’s One Stop Shop (OSS) regime.

VAT Rate: 21% VAT is typically applied to the sale of affected electronically supplied services

Will your business need to pay VAT on digital services in Spain in 2024?

Learn More About VAT on Digital Services in Spain

Marketplace & Platform Operator Rules in Spain

Spain applies the harmonized European Union’s (EU) VAT rules for marketplace & platform operators.

Supply of goods

A marketplace is deemed to have received and supplied the goods themselves. This transaction is split into two supplies:

- A supply from the underlying supplier to the marketplace (deemed B2B supply)

- A supply from the marketplace to the final customer (deemed B2C supply).

This rule covers the following:

- Distance sales of goods imported to the EU with a value not exceeding EUR 150

- Supplies of goods to customers in the EU, irrespective of their value, when the underlying supplier is not established in the EU (both domestic supplies and distance sales within the EU are covered).

Supply of services

When electronically supplied services are sold through an intermediary, e.g. a marketplace for applications, the intermediary is deemed to have received and supplied the services themselves. Therefore, the VAT liability shifts to the intermediary from the underlying supplier.

Invoice Requirements in Spain

The following information should be required on invoices in Spain:

- Document & General transaction information

- Number and series, if applicable

- Issuance date

- The date on which the transactions to be documented were carried out or on which an advance payment, if any, was received, where this is different from the date of issue of the invoice

- Supplier information

- Full name or business name, address, and NIF or, where appropriate, the VAT identification number of another Member State of the European Union (EU) with which the person required to issue the invoice has carried out the transaction

- Customer information

- Full name or business name, address, and, where appropriate, the VAT identification number

- Financial transaction information

- Description of the transaction

- VAT rate(s), if any, applied to the transaction(s)

- VAT amount charged if any

E-Invoicing & Digital Reporting for Spain

Since July 2017, quasi real time reporting through the SII ( Suministro Inmediato de Información) has been mandatory for taxpayers that are enrolled in the automatic refund mechanism with a turnover of more than EUR 6,010,121.06, and for VAT groups, for any type of transaction.

As a separate requirement, the three Basque provinces ( Álava, Vizcaya and Guipúzcoa) introduced a real time reporting system called TicketBAI. TicketBAI is only applicable in these three provinces. Since 2022, TicketBAI has been live. The implementation timeline differs among different regions.

B2G e-invoicing is mandatory for transactions with a value above EUR 5.000 in Spain and FACe platform is used for this type of transactions. However, there is no e-invoicing requirement for B2B invoices at the moment. That being said, according to the "Create and Grow" law, taxpayers should be required to issue e-invoices for each transaction. The timelines to comply with the upcoming B2B e-invoicing mandate have not been determined as it depends on the date of approval of the implementing regulations:

- Companies with an annual turnover exceeding €8m: one year after the date of the approval of the implementing regulation

- All other companies and professionals: two years after the date of the approval of the implementing regulation

The most recent update in Spain is the introduction of mandatory use of certified billing software from July 1, 2025, as per Royal Decree 1007/2023. The software must issue invoices and generate a record in a structured XML format with certain transactional data, which will need to be transmitted to the Spanish Tax Authority. Taxpayers subject to the SII are not under scope. The certified billing software requirement will coexist with the upcoming mandatory B2B e-invoicing mandate. Learn more about certified billing software requirements in Spain.

Learn more about E-Invoicing and Digital Reporting in Spain

Governmental Body Responsible for E-invoicing and Digital Reporting in Spain

Invoices received and issued should be reported via the SII (”Immediate Supply of Information”). SII is an information system created by the Agencia Tributaria, the Spanish tax authority. The report is made through its portal.

VAT Payments and Returns in Spain

Full VAT Returns

Spain does not provide a simplified VAT return for VAT-registered non-resident taxable persons supplying qualifying electronically supplied services. Instead, they can avoid registering for VAT in Spain and use the EU One-Stop-Shop (OSS) return.

However, for taxpayers required to file monthly returns, there is an option to use the Pre303, which pre-populates the VAT return and simplifies the filling process.

Penalties in case of late filings or misdeclarations

In the case of the late filing of VAT returns and payments, the Spanish Tax Authority enforces the following penalties:

- Late payment This penalty should be 50% of the amount due. However, it may be reduced by 30% if the taxpayer agrees to the adjustment made by the tax authority, or by 25% if the penalty is paid without protest.

- Late filing The penalty should be a percentage equal to 1%, plus an additional 1% for each full month by which the return is submitted after the deadline for submission. This penalty is calculated on the amount payable as a result of the late return. If the return is submitted more than 12 months after the deadline, the penalty should be 15%. It may also be reduced by 25% if payment is made without objection.

Fonoa does not provide professional tax opinions or tax management advice specific to the facts and circumstances of your business and that your use of the Specification, Site, and In addition, due to rapidly changing tax rates and regulations that require interpretation by your qualified tax professionals, you bear full responsibility to determine the applicability of the output generated by the Specification and Services and to confirm its accuracy. No professional tax opinion and advice. Fonoa does not provide professional tax opinions or tax management advice specific to the facts and circumstances of your business and that your use of the Specification, Site, and In addition, due to rapidly changing tax rates and regulations that require interpretation by your qualified tax professionals, you bear full responsibility to determine the applicability of the output generated by the Specification and Services and to confirm its accuracy.