VAT Guide for Businesses with Customers in the United Kingdom

VAT Rates in the United Kingdom

The standard VAT rate in the United Kingdom is 20%, with a reduced rate of 5% on certain goods and services. Some things are exempt from VAT, such as postal, health care, insurance, and financial services.

Northern Ireland is treated as a territory of the EU for customs, VAT (for goods only) and excise purposes.

VAT Registration Thresholds in the United Kingdom

- VAT registration threshold for domestic established sellers: GBP 90,000 annual total VAT taxable turnover.

- VAT registration threshold for non-established sellers: No registration threshold

- VAT registration threshold for non-resident suppliers of Digital Services: No registration threshold

- Northern Ireland (NI), operates a “dual”/”mixed” VAT regime and follows the European Union’s (EU) VAT rules for goods under the Northern Ireland Protocol and UK VAT rules for services. VAT registration threshold for distance selling of goods by non-established sellers to NI consumers: EUR 10,000 (net) per calendar year

British VAT Number Format

- For businesses, the VAT number consists of the prefix 'GB' followed by nine digits

- For businesses in Northern Ireland trading with the EU, the VAT number consists of the prefix ‘XI’ followed by the nine digits from the GB VAT number

- Format: XI123456789

- For individuals, on one hand, the Unique Taxpayer Reference (UTR), which consists of 10 digits

- For individuals, the other identification number is the National Insurance Number (NINO), which consists of 9 characters in total: 2 letters, 6 numbers, and 1 suffix letter.

- Format: AB999999C

- For individualsFormat: 9999999999

- For businessesFormat: GB123456789

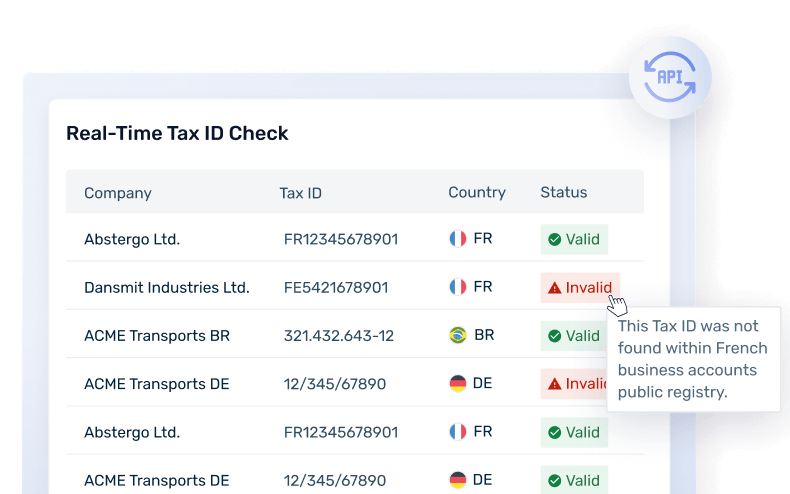

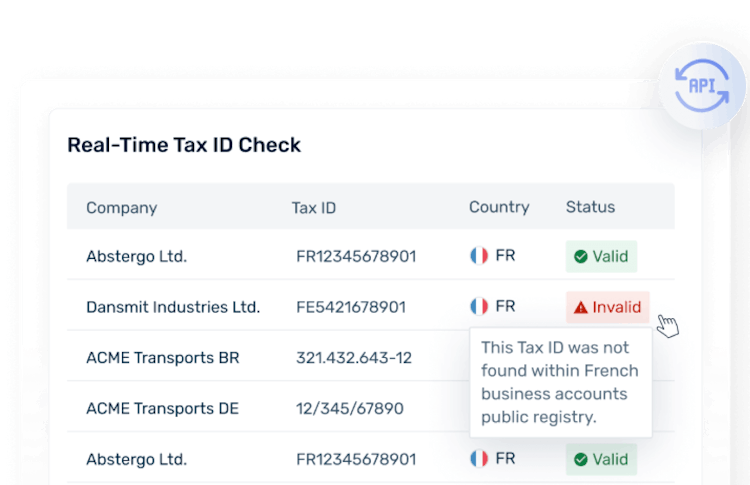

United Kingdom VAT ID Validation

Need to look up and validate VAT numbers in United Kingdom?

Explore Lookup

VAT on Digital Services in the United Kingdom

VAT on the provision of digital services has changed from January 2021 with Brexit. The rules of the harmonized Electronically Supplied Services (ESS) of the European Union (EU), especially the One Stop Shop (OSS,) no longer apply after January 2021.

For B2B supplies of digital services, the general place of supply rule for services has to be taken into consideration.

If a business supplies digital services to UK consumers (B2C), those supplies are liable to UK VAT.

If a business supplies digital services to consumers (B2C) outside of the UK then these supplies are not liable to UK VAT. They may be liable to VAT in the country where the consumer is based.

VAT Rate: 20% VAT is typically applied to the sale of affected Electronically Supplied Services.

Will your business need to pay VAT on digital services in the United Kingdom in 2024?

Learn More About VAT on Digital Services in the United Kingdom

Marketplace & Platform Operator Rules in the United Kingdom

If a business supplies e-services to consumers through an internet portal or marketplace, they need to determine whether they are making the supply to the consumer, or to the platform operator.

If the platform sets the general terms and conditions, authorizes payment or handles delivery or download of the digital service then the platform operator would be responsible for accounting for the VAT payment that’s charged to the consumer.

Invoice Requirements in the United Kingdom

The following invoice content should be required in the United Kingdom:

- Document & general transaction information

- Date of issue

- Sequential number of the invoice

- Date of supply

- Supplier information

- Name, address, and VAT number

- Customer information

- Name and address

- Financial transaction information

- Description and breakdown of the goods or services - quantity, unit price excl. VAT

- VAT rate

- Total amount of the goods or services excluding VAT

- Total amount of VAT

- Additional information that may be required:

- Discounts or rebates

E-Invoicing & Digital Reporting for the United Kingdom

E-invoicing is not mandatory in the UK for B2B, B2C and neither for B2G transactions, with one exception, however, there are formal legal requirements relating to the issuing, receiving and storing of e-invoices.

With effect from March 31, 2022, all invoices submitted to National Health Services Shared Business Services (NHS SBS) should be e-invoices.

Learn more about E-Invoicing in the United Kingdom

Governmental Body Responsible for E-invoicing and Digital Reporting in the United Kingdom

HM Revenue & Customs (HMRC)

VAT Payments and Returns in the United Kingdom

Full VAT Returns

Penalties in case of late filings or misdeclarations

In the case of the late filing of VAT returns and payments, the HMRC enforces the following penalties:

If the accounting period started on or after January 1, 2023

- Late returns

- For each late VAT return, taxpayers should get a penalty point. This also includes nil returns.

- Once the penalty point threshold is reached taxpayers should get a fine of GBP 200.

- Taxpayers get a further GBP 200 penalty for each subsequent late submission.

- Late payments

- Late payment penalty depends on how late a taxpayer pays.

- Late payment interest is charged from the first day that the payment is overdue until the day it’s paid in full. It’s calculated at the Bank of England base rate plus 2.5%.

If the accounting period started on or before December 31, 2022

- Late returns and payment

- HMRC will records if taxpayers are late with their VAT Return filing or payment

- Afterward, a 12-month long ‘surcharge period’ begins. A surcharge is an extra amount on top of the VAT taxpayers owe

- The surcharge is the percentage of the outstanding VAT

- No surcharge should be paid for the first default

- Depending on the annual turnover of the taxpayer (above or below GBP 150,000) and the number of defaults the surcharge can increase from 2% to 15%.

Fonoa does not provide professional tax opinions or tax management advice specific to the facts and circumstances of your business and that your use of the Specification, Site, and In addition, due to rapidly changing tax rates and regulations that require interpretation by your qualified tax professionals, you bear full responsibility to determine the applicability of the output generated by the Specification and Services and to confirm its accuracy. No professional tax opinion and advice. Fonoa does not provide professional tax opinions or tax management advice specific to the facts and circumstances of your business and that your use of the Specification, Site, and In addition, due to rapidly changing tax rates and regulations that require interpretation by your qualified tax professionals, you bear full responsibility to determine the applicability of the output generated by the Specification and Services and to confirm its accuracy.