Indirect tax technology for global businesses

Fonoa is the first global tax automation platform that allows you to validate tax IDs, calculate taxes, generate invoices and e-invoices, report transactions and file your tax returns through a single solution.

Let's talkTrusted by the world’s leading companies

Don’t let tax

block your business

Tax challenges of global businesses

Ever-changing tax rules and regulations.

No standardised government or vendor connections for digital reporting and e-invoicing.

Multiple sources of truth for tax information.

Solution

Always up-to-date with the latest tax regulations, automatically.

Worldwide coverage with a standard integration.

Full control and visibility through a single source of truth for all your tax data.

Fonoa supports tax compliance at the transaction level and simplifies your global tax landscape

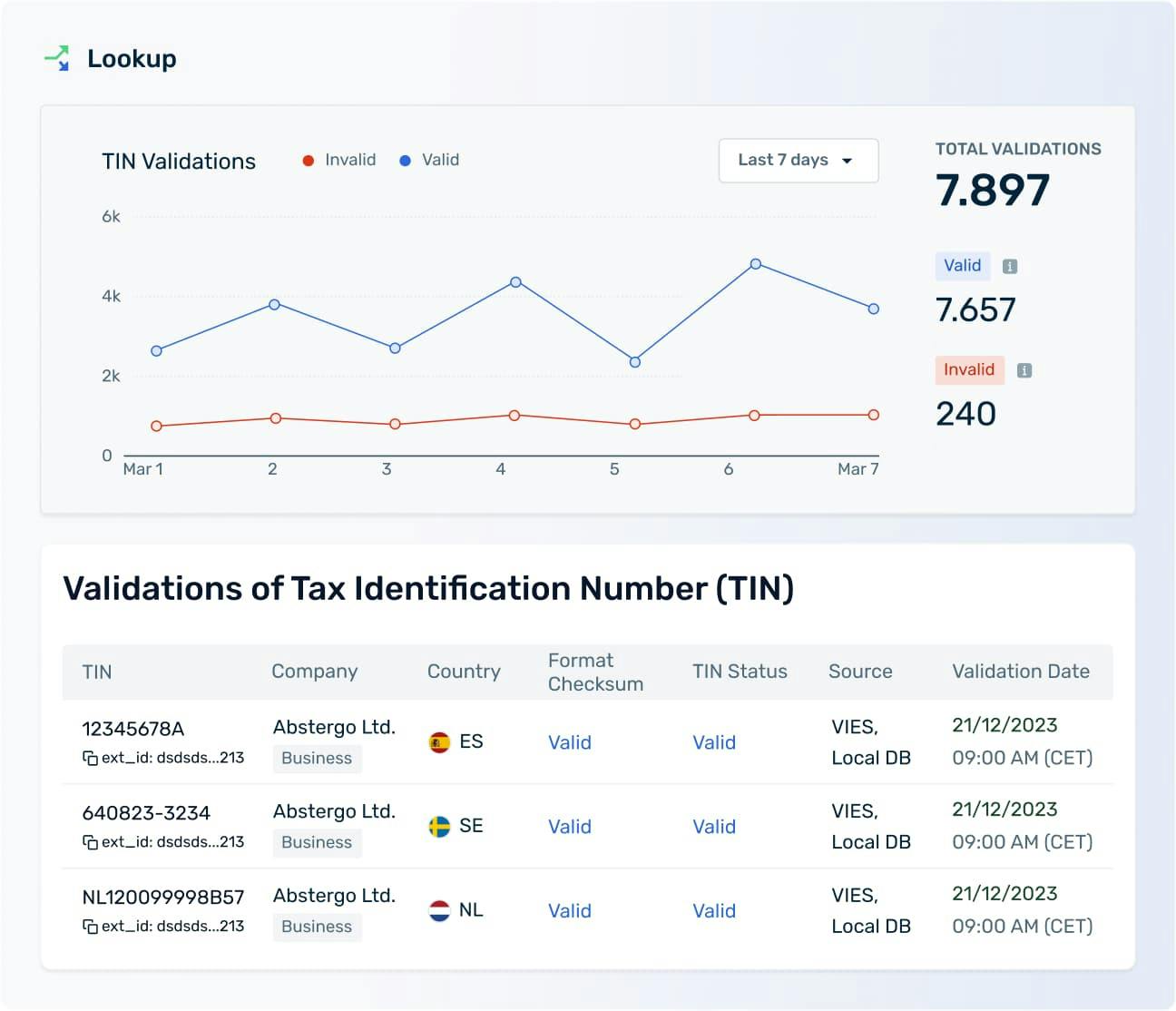

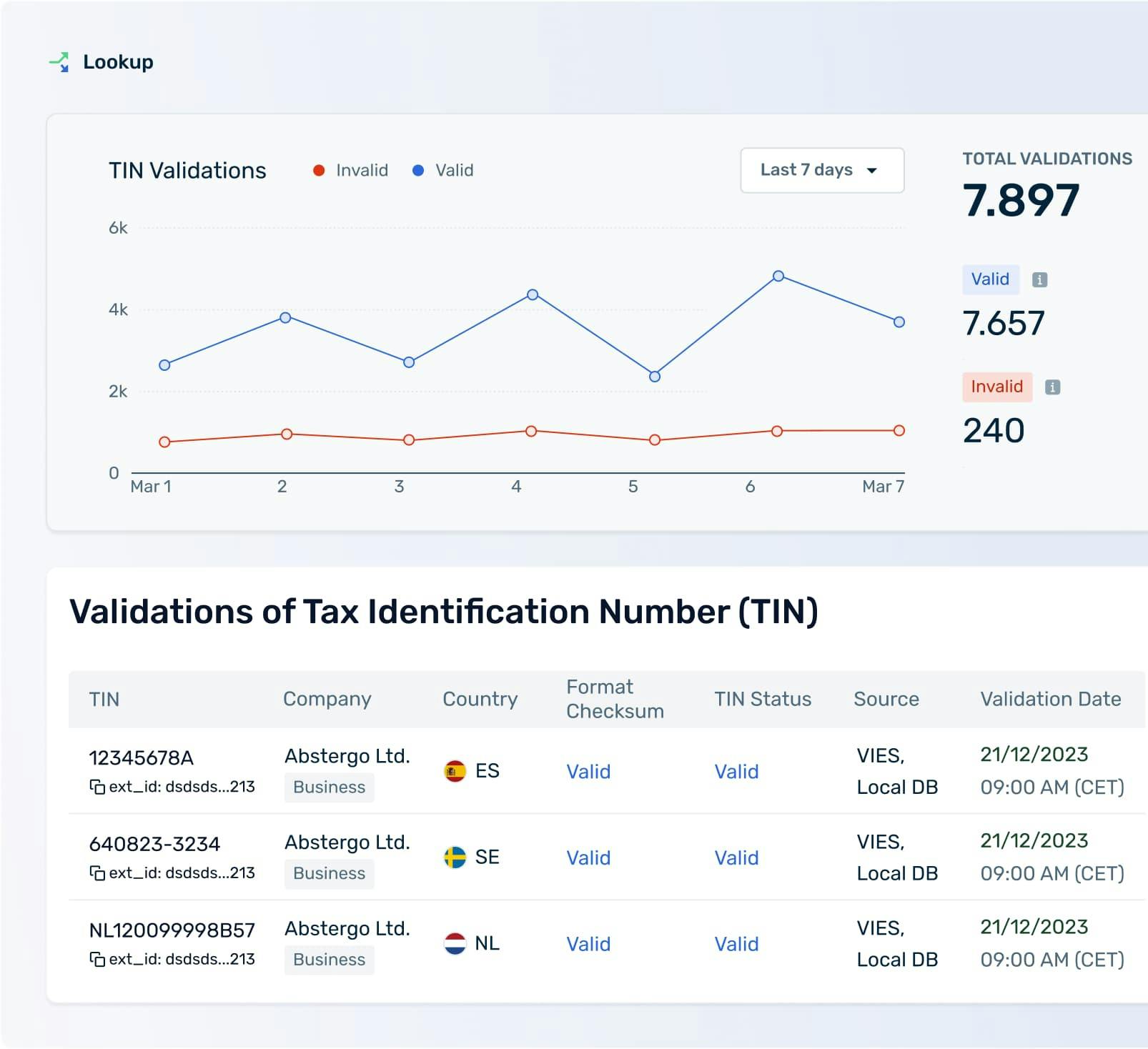

Validate tax IDs

Instantly validate VAT, GST and other tax IDs in more than 100 countries through official country databases for the most comprehensive and accurate validation.

Explore Lookup

Meet the visionary investors backing our journey, and enabling us to push boundaries in the industry

Secure platform, secure data

We’re constantly improving our security, audit, and compliance with you in mind.

Global tax compliance for marketplaces

Our team has unique experience, having worked at and grown some of the world`s largest marketplaces. That in-depth and specific knowledge has helped us design solutions specific to global marketplaces and platforms.

Learn more about MarketplacesWhat our customers are saying about Fonoa

Fonoa allows Uber to be able to validate taxpayer status both in VIES, and in the national databases across the EU, allowing us to have a complete picture over the taxpayer status of our supplier base.